When people think about credit card processing, they likely think of waiting for their transaction to process or their Merchant Service Provider, depending on which side of the transaction they inhabit. But there are a number of middlemen involved in credit card processing, and even businesses don’t necessarily interact directly with each one of them.

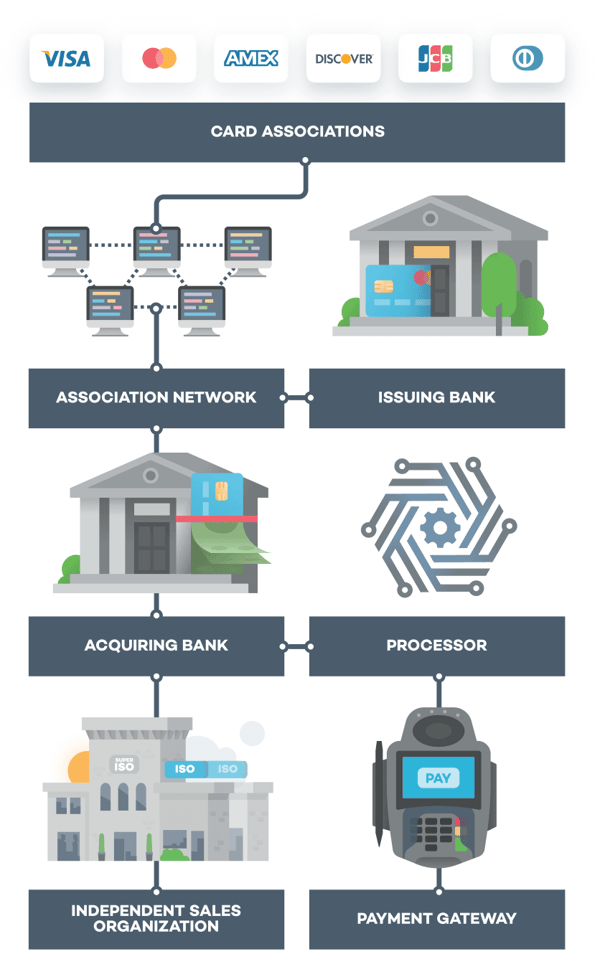

If you’re wondering, “How does credit card processing work?” and want a visualization, we have one just for you.

Let’s review what each of these providers does to enable credit card payments.

How Does Credit Card Processing Work: A Guide to Providers

- Card Associations: Visa, MasterCard, Discover and Amex. They focus on network operations to run transactions, research new anti-fraud techniques and set prices and rules for Interchange rates.

- Card Networks: Each of the Card Associations has its own network. They communicate with the issuing and acquiring banks during transaction authorization and attribute the transaction to the cardholder for billing.

- Issuing Banks: Financial institutions that print credit cards (e.g., Chase, Citi and Wells Fargo). They back the Card Associations and issue credit to cardholders. Some Card Associations double as issuing banks (e.g., Discover and Amex).

- Acquiring Banks: Banks that are members of the Card Associations and have agreements with Merchant Service Providers to accept deposits for credit card transactions.

- Independent Sales Organizations (ISOs): Companies that manage the sales, and marketing of the credit card processing products and services. They provide each of their customers with an individual merchant account. Another name for an ISO is a Merchant Service Provider. A super ISO has a direct agreement with a member acquiring bank and may also have sub-ISOs below it.

- Payment Processors: They maintain the computer network for communication between ISOs and banks. Often referred to as processors, they do not work directly with businesses. They are chosen by your ISO’s bank.

- Payment Gateways: Systems that facilitate communication between an online payment portal and a processor, enabling e-commerce and retail transactions. Gateways may work directly with businesses or through the processor.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How Payments Unfold: From Customer to Business

In the 10-odd seconds you’re waiting for a chip card transaction to process, a six-step process occurs to authorize each credit card transaction your business takes. Here’s how the providers interact.

- The customer swipes or inserts a credit card. The cardholder initiates payment using the merchant’s card reader, usually provided by the ISO.

- The transaction is sent to the processor. The ISO communicates the transaction information to its Payment Processor.

- The transaction is relayed to the network. The Payment Processor, acting as the technical glue, communicates the transaction to the Card Association’s network.

- Funds are checked. The acquiring bank checks with the issuing bank via the Card Association’s network to determine whether sufficient credit or funds are available.

- An approve or deny code is issued. The acquiring bank communicates the information back to the ISO via its Payment Processor.

- Funds are transferred. If approved, the transaction will process, and the Card Association network will facilitate the transfer of funds from the issuing bank to the merchant’s depository bank account.

Want to learn even more about credit card processing?

What further questions do you have about credit card processing? We’d love to hear from you!