Why don’t businesses accept American Express as commonly as Visa and MasterCard? Traditionally, a huge profit driver for Amex was its high Flat-rate processing, making it more expensive and less appealing to businesses. True to form, Amex also operated a bit differently than Visa and MasterCard when it came to the configuration of its merchant accounts until now.

Businesses that wish to accept American Express cards are in luck; there’s a new platform with lower fees and simpler management. But not all businesses can opt in. Here’s an overview of Amex OptBlue and Amex Direct.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Amex OptBlue

Previously, Amex cards were processed through a separate American Express-managed merchant account. Rates were high and non-negotiable and it doubled the number of parties involved in a business’s credit card processing.

In 2014 American Express launched Amex OptBlue. Unlike the previous approach, Amex OptBlue allowed Merchant Account Providers to process Amex transactions just like MasterCard and Visa.

Benefits of this new model include:

- Faster payment: Now, all deposits from Visa, MasterCard, Discover and Amex are on the same deposit schedule.

- Improved reconciliation: With one provider, deposits are streamlined for easier reconciliation.

- One billing statement: With OptBlue, Amex deposits are listed on the same monthly billing statement as other cards.

- Shared support: Your Merchant Account Provider can assist you with all aspects of your account and answer transaction questions, regardless of card type.

- Negotiable rates: Providers now manage the rate structure for Amex cards, resulting in huge savings over the former Flat-rate plan.

It’s a win-win for businesses looking to simplify their credit card processing and save money (not to mention accept more payment methods)!

So, why would American Express opt to drop its merchant account business? It’s actually a smart move. Small businesses that previously shied away from accepting its cards can do so affordably now, which could ultimately encourage greater cardholder adoption.

But Amex isn’t leaving all merchant account profits on the table. There’s one criterion by which the old paradigm still applies: Amex Direct.

Amex Direct

Amex Direct is a separate, mandated merchant account specifically for businesses processing $1 million or more annually in American Express transactions. With it, Amex still generates revenue on high-volume accounts. Businesses on Amex Direct will recognize the high flat rates from the former merchant account structure.

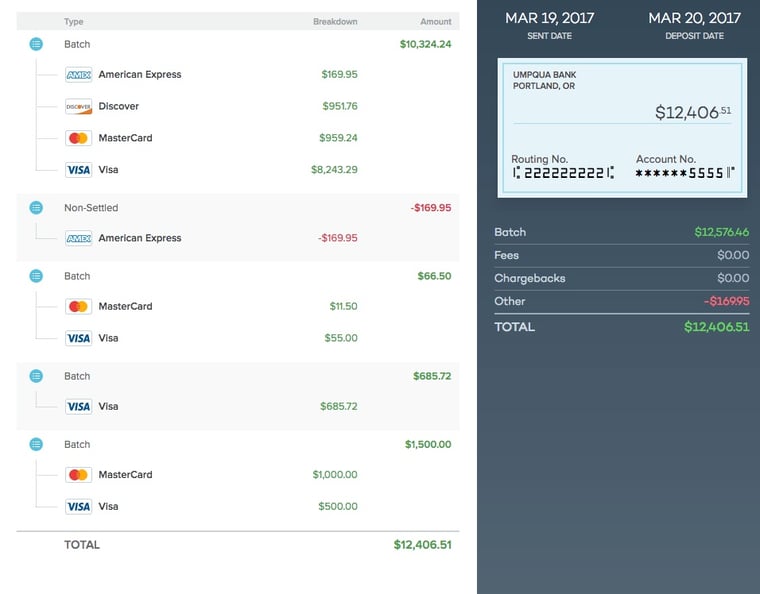

Although businesses on Amex Direct receive their Amex deposits separately, PayJunction’s system makes it much easier for these businesses to reconcile their deposits.

In the example above, a debit of $169.95 is noted because this business has a separate Amex Direct account and will receive that deposit directly from American Express.

Without this denotation, the business’s accounting team would struggle to reconcile the batch amount with the deposit hitting the business’s bank account ($12,576.36 versus $12,406.51 in this example). We make it easy to identify discrepancies to help businesses on Amex Direct with reconciliation.

With the right provider and new OptBlue platform, accepting Amex cards should be easier even for businesses that are mandated to have an Amex Direct account.

Is your business on OptBlue or Amex Direct? What is your current reconciliation process like? We'd love to hear from you.