Thus far, this series has covered a range of fake fees and markups. To no one’s surprise, some providers also practice unethical billing around Amex fees. Before we dive in, here’s a quick explanation of processing options for businesses that accept Amex.

Amex Direct vs. Amex OptBlue

American Express is a unique company. It’s not only a card association, but can also provide businesses with merchant accounts to process its cards. Businesses have two options for accepting Amex: Direct or OptBlue.

Businesses that process over $1 million annually are required to process directly through American Express via Amex Direct. With an SE account, Amex directly deposits funds into your bank account and bills you on a separate statement from the rest of your credit card processing. This complicates bookkeeping for accounting teams.

OptBlue allows traditional Merchant Account Providers to process and deposit Amex transactions on behalf of American Express. Although American Express is “hands off” with this setup, American Express still charges fees that your provider will pass onto you. With OptBlue, all fees, including Amex fees, are listed on one merchant statement from your Merchant Account Provider.

We’ve found two particular fees, set and charged by American Express, that unethical providers markup. These fees are specific to Amex OptBlue.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Markup on Amex Fees

- Card-Not-Present Fee

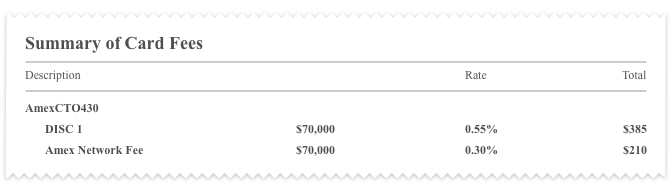

The American Express Merchant Reference Guide outlines fees associated with processing Amex transactions. For non-swiped transactions (aka card not present), American Express charges a 0.30% fee on the total volume of non-swiped Amex transactions for the month. Our team has seen this fee marked up as high as 1.43%. Here’s what this markup may look like on your merchant statement:

In this example, the provider added a 1.13% markup to the CNP fee, profiting $56.50 off the business. Over the course of a year, that’s $678 in the provider’s pocket.

- Network Fee

Amex also charges a network fee of 0.15% for OptBlue. Unfortunately, we’ve seen providers tack a markup onto this fee as well.

Because ‘Amex’ denotes what the fee is for, most business owners don’t question the rate charged, or really understand what the fees are for. Merchant statements are also inherently complex, making it easy for providers to use unethical tactics in their merchant statements.

Avoid Markups on Amex Fees

Most businesses that accept Amex cards and process under $1 million annually are on OptBlue. This gives unethical providers the opportunity to capitalize on more fees to create more revenue for themselves. With OptBlue being the new norm, more businesses could become victims of these unethical billing practices. Ensure you’re being charged fairly by working with an honest, ethical provider.

Do you process via Amex OptBlue? Tell us if you've seen these fee inconsistencies on your statements in the comments area below.