Some Merchant Account Providers take advantage of their customers and charge unnecessary merchant credit card processing fees. In part two of this series, we will identify seven unwarranted merchant service fees your provider may be charging you.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

-

Payment Card Industry (PCI) Compliance Fee

Providers use this merchant fee as a revenue stream if your business is categorized as non-compliant. This fee can be imposed yearly, monthly or both, depending on your provider. It does not serve a purpose beyond reminding you that your provider has no verification of your business's compliance. Fair providers guide businesses to take the necessary steps to be compliant, rather than penalize them.

-

Self-Assessment Questionnaire (SAQ) Fee

Similar to the PCI compliance fee, the SAQ fee is imposed if your business fails to complete the SAQ to verify its compliance. This merchant fee is typically charged yearly, however — if your provider is a stickler — you may get charged quarterly or even monthly until the SAQ is submitted.

Trustworthy providers don't charge for this or even require the SAQ to be submitted. The SAQ is meant to be a self-assessment of your business (hence the name) — not an evaluation by your provider.

-

Address Verification System (AVS) Fee

This merchant fee is charged to run the AVS to match the address provided with the address registered with the card. It is charged for every transaction where the AVS is run, even if the transaction is declined. This fee should not exceed $0.01 per transaction. However, as you can see below, the provider is charging 10 times the true cost.

-

Next-Day Funding Fee

Some providers will charge a merchant service fee for next-day funding, which is sometimes considered an accelerated funding time. This is typically a flat dollar amount charged monthly. It does not cost your provider any money to provide next-day funding, so there should never be a charge for it on your statement.

-

Tax-Reporting Fee

Providers are legally required to report each customer's revenue to the IRS, though some charge a merchant fee to their customers to report it. This is, yet again, another way for providers to make an extra buck.

-

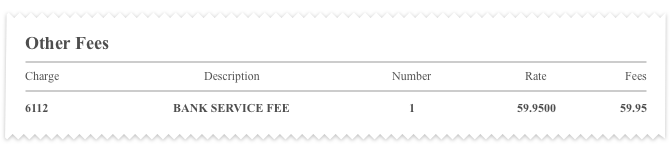

Bank Service Fee

Some providers add in a generic “bank service fee” that further pads their profits. The terminology is vague. What service does this fee cover? Is this a pass-through fee levied on your provider by the bank?

Considering how many fees seem to be included monthly or quarterly in a business’s merchant statement, it’s easy to see how providers get away with masking this additional monthly fee as something legitimate.

Remove Unnecessary Fees From Your Statements

Unfortunately, it's easy for providers to hide fees from you due to the complexity of merchant statements. Review your current merchant statements and see if you can spot any questionable fees. If your provider is charging you unnecessary merchant fees and refuses to drop them, then it's time to switch to a reliable provider. By confirming that you're paying fees that are necessary, you can save your business a lot of money in the long run.

Are these fees in your statements? Find out with our Merchant Service Provider Assessment!

Have you worked with a provider that charged you unnecessary merchant fees? What types of fees did they charge? Don’t hesitate to share in the comments section below.