Due to the complexity of billing statements, many Merchant Account Providers practice unethical billing. In part four of this series, we will reveal padded dues and credit card assessment fees: another way providers make money by hiding fees from their customers.

What Are Dues and Credit Card Assessment Fees?

In addition to the cost to run the transaction (Interchange), card brands charge dues and credit card assessment fees to cover:

- Network operations to run transactions

- Price and rule setting

- Marketing expenses

- Research and development of new technologies to fight fraud

Dues and credit card assessment fees are charged by the card brands and paid by Merchant Account Providers, but the fees are passed onto their customers. The card brands update dues and credit card assessment fees periodically, but they are not modified as often as Interchange.

These fees are the same for all providers, which means they are the same for you, too. Full details are included in each card brand’s Interchange guide, but here’s the typical breakdown:

- Visa, MasterCard and Discover charge between 0.11% - 0.13% for dues and assessments

- Amex charges 0.15% for dues and assessments

These fees are charged monthly on the volume for each card brand you accept, so you should see percentages consistent with the breakdown above. However, if you’re working with a deceptive provider, your monthly statements may reflect a higher percentage for dues and assessments.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Padded Dues and Credit Card Assessment Fees

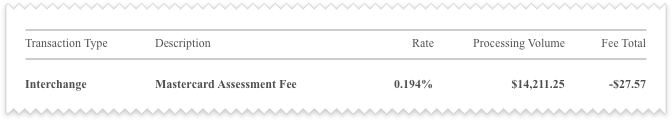

By hiding an additional markup in the dues and credit card assessment fees, your provider's fees become padded. Your statement should reflect the percentages that the card brands publish in their Interchange guides. Unethical providers know most customers won’t look at these, so they sneak in a markup. Here’s an example:

- This provider is claiming MasterCard’s credit card assessment fees is 0.19%

- The true MasterCard fee is between 0.11% - 0.13%

- The provider is hiding a markup between 0.06% - 0.08%

Where you find these fees on your merchant statement depends on your provider. Sometimes they are just listed under fees, or separated into another section titled Card Association Fees. By charging them, unethical providers take advantage of their customers' trust in their service.

Padded Credit Card Assessment fees and Dues: Tips to Avoid Them

With a little research on your part, you can determine if you’re being charged for this. Cross-check your current merchant statements with the dues and credit card assessment fees listed in the most recently published Interchange guide for each card brand.

We recommend getting a statement analysis by a professional to confirm this, as statements are complex and typically contain more than meets the eye. Work with a transparent provider to ensure you’re paying the lowest fees possible.

Identify over a dozen unethical fees with our Merchant Service Provider Assessment!

Have you been charged hidden fees? Are you concerned you’re getting overcharged on regulated fees? Please share below. We’d love to hear from you.