So far, we’ve covered how some Merchant Account Providers practice unethical billing when charging you, but providers can also be deceptive when your business runs a return. In part five of this series, we will uncover how some providers intentionally fail to reimburse Interchange on returns.

The (Ideal) Refund Process

Card Associations set the rules for Interchange refunds, which are posted on their websites. While Amex does not reimburse any processing fees to businesses for refunds, Visa, MasterCard and Discover do state that Interchange should be payed back.

So, when you issue a refund, your customer gets back what he or she paid, plus sales tax, and your business is reimbursed a portion of the fees paid to your Merchant Account Provider. Typically, providers will only reimburse Interchange and not their markup.

The rate plan you're on will determine what you receive back:

- Tiered = No processing fees are returned because of pricing setup

- Interchange-plus = Interchange should always be returned

- Flat = No processing fees are returned because of pricing setup

Unfortunately, statement complexity allows some providers to take advantage of their customers and retain a portion of the fees they should get back in the event of a refund.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Interchange Not Refunded

When a provider fails to reimburse Interchange, it is simply not listed on your statement. Statements are so cluttered with information and intentionally ordered in a way to confuse customers, so it's easy to miss.

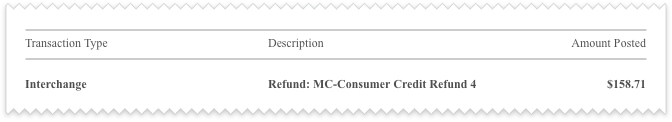

Here’s an example of what you should see when a trustworthy provider reimburses Interchange:

Get Interchange Refunds Processed the Right Way

If you’re on Interchange-plus, you should see Interchange reimbursed on your statements. Interchange-plus is the most transparent rate plan you can have, but there’s a chance your provider is failing to properly process Interchange refunds. If you’re on the Interchange-plus rate plan, cross-check your statements with your books to confirm that you're repaid Interchange. If these funds are missing, it might be time to consider a new Merchant Account Provider.

Were you aware of the reimbursements due when you issue a refund? Are you going to check your statements to ensure your provider accurately processes Interchange refunds? Start a discussion in the comments section below!