For starters, there are more rate plans for your business to consider than just Flat and Interchange plus pricing. That said, comparing too many options at once can be overwhelming; therefore, we’re going to focus on only two plans to simplify things a bit.

If you’re just starting to accept credit card payments, a Flat rate plan might be the best to start with. If your business is more mature, Interchange plus rates will likely be more advantageous. Let’s dive into an explanation of each option.

Flat Rate Pricing

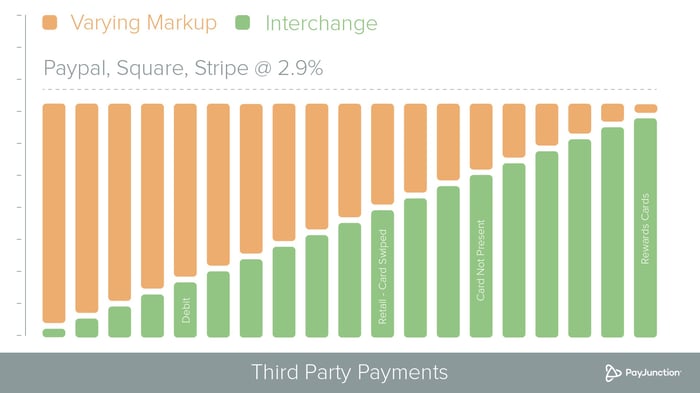

Payment Facilitators offer their customers Flat rate pricing, so if you’re with Square, Stripe or PayPal, this is your rate plan.

Flat pricing is simple: Every transaction has the same processing cost. To make this work, though, your provider has to cover both high- and low-cost scenarios, ultimately charging more for transactions that would cost less on a different plan.

Flat pricing consists of the Interchange — or wholesale cost to run a transaction — plus a mix of fees that produce one, consistent rate. It seems simple, but with Flat pricing it’s impossible to determine what type of cards you’ve taken. As a business owner, getting a proper discount for lower cost cards is essential. For instance, debit cards have a lower Interchange cost because they’re considered lower risk. By paying a Flat rate, you end up paying more for these transaction types.

As stated above, newer businesses that turn to a Payment Facilitator due to ease of access might prefer the simplicity of Flat rate pricing, especially if their processing volume is low. However, as a business matures and accepts more credit card sales, the benefits of transparency and access to low costs for debit cards start to make financial sense.

Recap: Pros and Cons of Flat Pricing

Some of these items were not covered in the above information, but you can learn more at the following URLs.

Pros:

- Low barrier to entry

- Simple to understand

- Good for new businesses that don't qualify for an individual merchant account

Cons:

- Higher overall credit card processing rates

- Risk of held funds

- True debit pricing is not passed on to the business

- Not cost-effective for mature businesses with high processing volume

Interchange Plus Pricing

.jpeg?width=700&name=Interchange-plus-rate-1%20(2).jpeg)

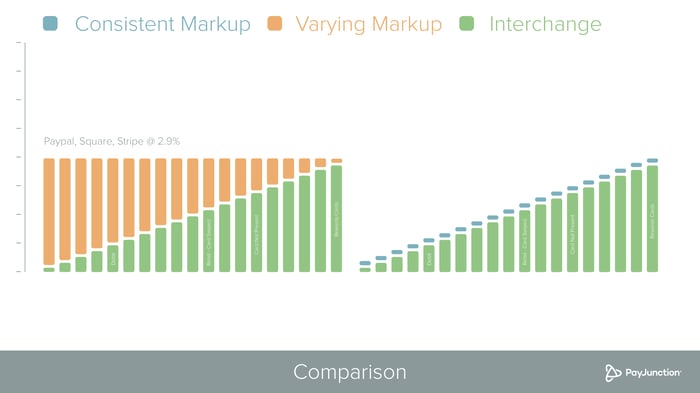

Interchange plus, when done right, is the most transparent rate plan out there. It simply charges the Interchange cost plus a flat markup on each transaction. On this plan, it’s clear where your money is going between the card issuers and your provider.

If you choose Interchange plus rates, know that you’re opting for clear merchant statements and lower transaction costs on average, since a higher rate isn’t attributed to each transaction to cover all potential scenarios (as is the case on Flat rate pricing).

To get on this rate plan, your business must go through merchant underwriting for a proper merchant account. This takes some time, which is why newer businesses often forgo this step and settle for a Payment Facilitator. However, improper merchant underwriting can lead to held funds that limit the business’s cash flow.

To illustrate this, a swiped card on Interchange plus has a rate of 1.6% (1.51% in Interchange plus a 0.09% provider markup). However, PayPal charges 2.7% for swiped transactions, meaning you’ll pay 1.1% more on each of these transactions with PayPal compared to a provider offering Interchange pricing.

Recap: Pros and Cons of Interchange Plus Pricing

Pros:

- Proper account underwriting and no risk of held funds

- True debit pricing is passed on to the business

- Transparent, cost-effective wholesale pricing

- Better for mature businesses with high processing volume

Cons:

- New businesses may not qualify for an individual merchant account to obtain this plan

Choosing the Best Plan for Your Business

It's evident in the diagram above how Interchange plus pricing can save you money on a majority of transactions types (Flat is showcased on the left).

To make the right decision, you should ask yourself a few questions. How much do you expect to process on credit cards each month? Does your business have time to get properly underwritten?

If you’re just getting off the ground, you might not qualify for a proper merchant account and, hence, may decide to simply use the shared merchant account a Payment Facilitator offers, despite some inconveniences.

If you’re unsure which plan you’re on, it’s vital to get a professional statement analysis to verify that your provider is fairly charging you.

Are you on Flat or Interchange plus pricing? Are you considering making a switch? Why? Let us know about your credit card processing journey in the comments section below.

Editor's Note: This post was originally published in January 2017 and has been updated for comprehensiveness and accuracy.