There’s a lot to consider when you’re starting a new business or even just updating your payment processing; and your rate plan can greatly impact your bottom line. We’re going to review two common rate plans side by side: Flat vs. Tiered pricing.

Flat Pricing

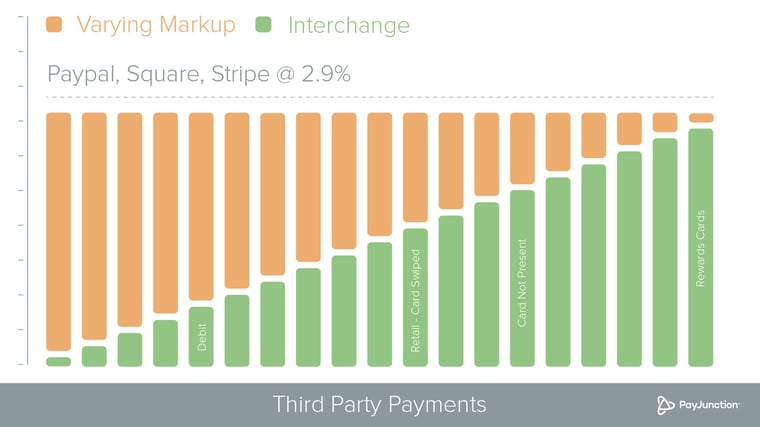

Flat pricing is a common choice for smaller businesses with low transaction volume. It’s offered by Payment Facilitators (think Square, Stripe and PayPal) that don’t require merchant underwriting and instead lend one mass merchant account to all of their customers. This makes Flat pricing a quick fix for businesses as they start out.

Flat pricing is exactly how it sounds: All transactions receive the same rate. How? The rate applied is made up of Interchange — the wholesale cost to run a transaction — plus a mix of different fees that create one standard rate. It’s not cost-effective because businesses on this plan end up paying more for most transactions, since the provider is trying to create a one-rate-fits-all rate.

For instance, PayPal charges 2.7% on all swiped transactions, although a swiped card might incur a rate as low as 1.69% with Tiered pricing.

Transactions can qualify for different processing rates? Yes, but not on this plan. More on that in a moment.

Those on Flat pricing don’t receive Interchange refunds. This can really add up for high-volume, mature businesses but might be less critical for smaller businesses with low credit card sales.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Tiered Pricing

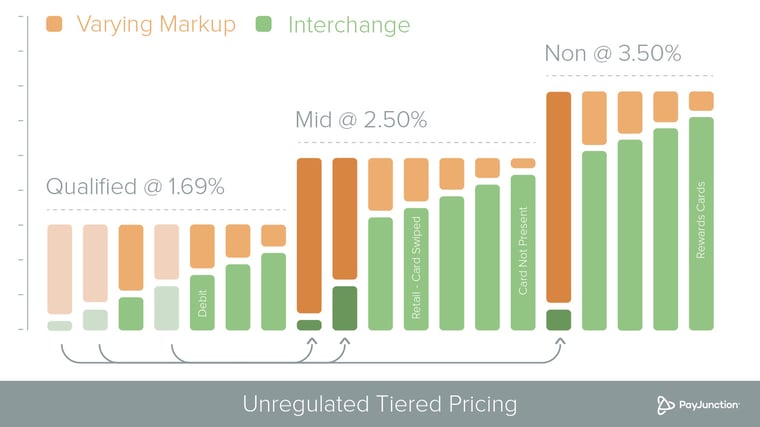

With Tiered pricing, transactions are bundled into three price tiers: Qualified, Mid-Qualified and Non-Qualified. The risk and reward associated with the transaction dictates which tier it falls into, however this plan isn’t regulated, so the threshold for a transaction to enter a new tier is somewhat subjective.

For instance, a Qualified transaction could cost 1.69%, but could increase to 2.50% if downgraded to the Mid-Qualified tier. Transactions that receive Qualified pricing have the lowest transaction costs, meaning they’re less risky and aren’t made with a rewards credit card. However, it’s possible for transactions to downgrade into higher rate tiers. Some downgrade triggers are within the business’s control; others aren’t. Common ones include:

- AVS mismatch

- Batches not settled within 48 hours of authorization

- Tax and tips not entered separately from transaction totals

- Mismatch of settled transaction amounts and original values

- Business and rewards cards

Some providers intentionally let their customers downgrade to make more money on their transactions. Because Tiered pricing isn’t regulated, it’s harder for businesses to know what triggers a downgrade and whether they’re being hit with excessive downgrades. A third-party statement analysis is the best way to confirm whether a provider is taking advantage of its customers. Those with a Tiered rate plan also don’t benefit from Interchange reimbursements on refunds.

Tiered pricing does tend to be more cost-effective than Flat pricing, overall, because a higher rate isn’t attributed to every transaction. That said, neither plan is particularly transparent. Those seeking a Tiered rate plan must undergo merchant underwriting and obtain an individual merchant account.

Selecting the Best Rate Plan

You’ll want to evaluate your priorities before selecting a Flat or Tiered rate plan. Newer businesses doing a low volume of transactions often benefit from Flat pricing if they prioritize easy setup.

More mature businesses that want lower processing rates should consider getting properly underwritten and obtaining an individual merchant account. Then they should keep an eye on the percentage of their transactions that downgrade each month to keep their providers in check.

Is your business currently on a Flat or Tiered rate plan? How’s it going? We’d love to hear from you!