Declined transactions are stressful. No cardholder likes being in that position, and it’s a tense situation for business owners who lack answers to rectify the issue.

After all, there are four parties involved:

- Cardholder: The customer attempting to make a purchase.

- Issuing bank: The bank that issues and manages the customer’s credit card.

- Business: The establishment selling the product or service.

- Merchant Account Provider: The company facilitating payments between the Card Association’s network (powered by Visa, MasterCard, Discover and Amex) and the business’s bank account.

Before we answer the question "What is AVS mismatch?" we need to define AVS itself.

AVS is a fraud-prevention measure implemented on card-not-present transactions like e-commerce and phone orders. AVS requires the cardholder to provide the full billing address for the card, including address and ZIP code. Card Verification Value (CVV) is often implemented to confirm the purchaser has possession of the physical card.

Address Verification System (AVS) declines are particularly tricky. Although it’s recommended to always use AVS and CVV, most Merchant Account Providers let businesses turn these security settings on at their discretion. When businesses require these fields to match before approving the transaction, they run into some confusing circumstances when a mismatch occurs.

Here are a few scenarios that trigger an AVS decline and how to rectify them. This practice is universal among providers, but for the sake of simplicity, we’ll showcase examples for how this looks in PayJunction’s Virtual Terminal.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

AVS Mismatch With Your Merchant Account Provider

Scenario No. 1: A customer is making a purchase, but there’s an AVS mismatch between the address or ZIP code. The transaction is declined in PayJunction, but the customer notices the purchase in his pending transactions. The business owner believes the transaction didn’t go through, but the customer’s bank says it did.

While the card networks and issuing banks benefit from fraud-prevention measures like AVS and CVV, they’ll still approve transactions with an AVS mismatch. Merchant Account Providers won’t if these security settings are selected.

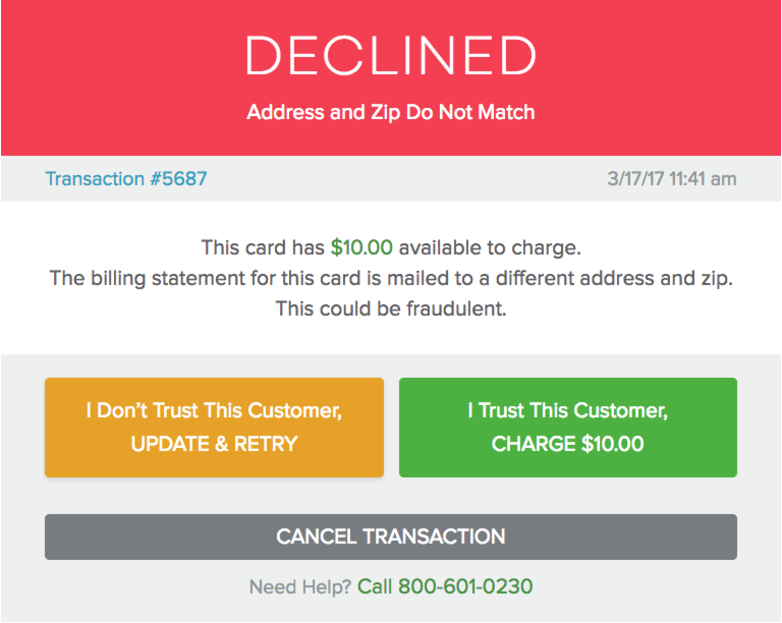

PayJunction customers will receive a notification like this:

The transaction is approved by the issuing bank but is declined in PayJunction’s system. Businesses have three options in this scenario:

- Try again in case information was entered incorrectly.

- Override the system to approve the transaction.

- Cancel the transaction.

It’s best to cancel the transaction if you don’t know the customer to avoid a potentially fraudulent transaction. If you know and trust the customer, you’re welcome to override the system, but doing so will incur a higher transaction rate that accounts for risk. If you rerun the transaction and it continues to fail, it will create more pending transactions on the customer’s credit card statement and more declines on your end, simply exacerbating the problem.

If you let the transaction decline, even after multiple attempts, the mixup will be resolved when you settle the day’s transactions. Once settled, the Merchant Account Provider notifies the issuing bank that the authorization was reversed and the bank credits the customer (over the course of 24 hours for debit cards and a couple of days for credit cards).

If you run a transaction multiple times and simply override one, the overridden transaction is the only one that will go through in PayJunction’s system. The others will be reversed per the description above.

AVS Mismatch With Your Bank

Scenario No. 2: A customer provides a true billing address, but an AVS decline occurs. The cardholder swears the information was updated with the issuing bank, but there are two reasons the bank records still might not match the address provided.

P.O. Boxes

If the customer provides a P.O. Box, a mismatch can occur if the bank does not commit to the same recording practices as the Merchant Account Provider. It’s considered a best practice to truncate the “P.O. Box” and simply verify the numbers provided. But not all banks do that, which results in mismatches of “123” and “POB,” for instance.

The cardholder can resolve this problem by calling the issuing bank and informing it that the P.O. Box is entered incorrectly for verification purposes.

Mailing Address Update

Updating your mailing address is top of mind after a move, but that’s not enough to avoid an AVS decline. Updating a mailing address will ensure credit card statements reach the new home, but that’s it; the billing information for the card isn’t automatically changed.

The cardholder simply needs to contact the card’s issuing bank, request an update to the billing address and move forward with the payment.

Knowing How to Address an AVS Mismatch

In summation, here’s a quick cheat sheet for dealing with AVS declines on the fly:

- If you know the customer, reduce the hassle and continue with the payment.

- If you don’t know the customer, consider retrying if you potentially entered the information incorrectly over the phone. For e-commerce transactions, consider canceling the transaction entirely to prevent fraud.

- Explain to the customer that the transaction isn’t actually approved, despite what the bank might be saying.

- If a customer swears up and down that the information is correct, inform the customer of the P.O. Box issue if applicable. If that isn’t the issue, ask whether the customer recently updated the billing address.

We hope this information can reduce some payment friction, maintain your happy customer base and result in less frustration for all parties involved going forward.

Have you run into awkward AVS declines at checkout? What has your experience been in resolving the issue? Let us know in the comments section below!

Editor's Note: This post was originally published in March 2017 and has been updated for comprehensiveness and accuracy.