MOTO stands for Mail Order/Telephone Order and is a credit card processing pricing setup on a Tiered plan. MOTO credit card processing is best suited for businesses that primarily accept card-not-present transactions: Examples include e-commerce and delivery-based businesses. In contrast, Retail pricing is appropriate when the majority of transactions occur in-person.

It’s important to establish the correct setup, which depends on the type of business you run. Failing to do so could result in higher rates, incorrect risk assessments and lost savings opportunities.

How Tiered Pricing Works

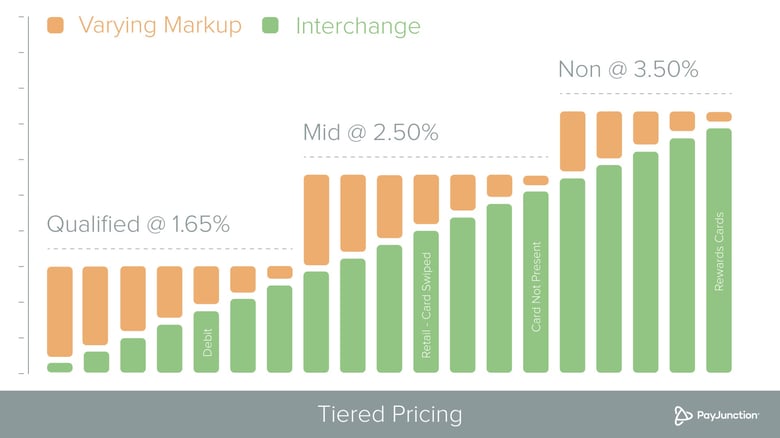

With Tiered pricing, transactions are bundled into one of three buckets: Non-Qualified, Mid-Qualified and Qualified. Known as tiers, Non-Qualified transactions have the highest cost, and Qualified transactions have the lowest cost.

Risk and reward factor into the cost associated with a given transaction. For instance, in-person debit transactions carry little risk and are, therefore, less expensive. In contrast, rewards cards carry a higher cost to cover the value of the rewards provided.

It’s important to note that Tiered pricing is not regulated. It may seem straightforward, but there is no official guidebook for the tier a given transaction will fall into, which makes it easy for unethical providers to note transactions in any tier they like, potentially making the transaction cost higher than it should be.

In terms of “how” MOTO credit card processing works, businesses typically key card-not-present transactions in to a Virtual Terminal or accept them via their online shopping carts. A Virtual Terminal is a companion, web-based application that syncs with your credit card terminal (if you accept in-person payments) and helps you manage your transaction history and activity online. There are numerous online shopping cart providers that make it easy to deliver a conversion- and user-friendly experience.

So, how does your Tiered account setup affect your rates?

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How Tiered Pricing Changes on MOTO vs. Retail Setup

When a business is set up on MOTO pricing, it’s expected that it’ll process the majority of its transactions over the phone or online. With this setup, the Check Qualified tier is absent, as it does not pertain to these higher-risk transactions. Overall, e-commerce businesses and others with a majority of card-not-present transactions pay higher fees to account for the heightened risk of accepting payments without seeing customers in person to verify their identities.

In contrast, a business on retail setup is expected to process the majority of its transactions in person. In this case, a card-not-present transaction could be downgraded to a higher rate tier (e.g., moved from Qualified to Mid- or Non-Qualified). This downgrade happens because card-not-present transactions aren’t accounted for with this rate plan.

Reducing Risk and Improving Rates on MOTO Pricing

If you operate an e-commerce business, you can improve the chances of your transactions landing in a lower-cost tier by taking heed of some safety precautions. Address Verification System (AVS) and Card Verification Value (CVV) are both card-not-present, fraud-prevention measures that should be required on every transaction you take. AVS costs $0.01 per transaction and verifies that the billing address the customer enters matches the address on file for the card with the bank. Approving transactions with an AVS match can reduce your risk of chargebacks and fraud and can help you achieve lower credit card processing rates.

CVV is the three-digit number on the back of MasterCard, Discover and Visa cards or the four-digit number on the front of Amex cards. Requesting it either over the phone or in your online shopping cart confirms that the customer has physical possession of the card.

Doing your part to reduce risk will help you achieve the best MOTO credit card processing rates.

See if there's room to improve your current rates.

Are you on the right pricing plan? What questions do you have about MOTO credit card processing? We’d be happy to answer them.

Editor's Note: This post was originally published in October 2018 and has been updated for comprehensiveness and accuracy.