Many Merchant Account Providers charge unnecessary fees or have unfair contract terms and conditions, as reported in our unethical practices blog series. Some providers take it a step further by failing to educate business owners about how to qualify for the best transaction rates, which unfortunately results in “Interchange downgrades” that can really add up. Worse yet, some providers make so much money from these downgrades that they hide them in confusing line-item details on statements.

The truth is that many Interchange downgrades are avoidable and you can easily keep more of your money by working with an ethical processor and following a few best practices.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

What Are Interchange Downgrades?

Interchange is the fee that the card brands charge to process a credit or debit card transaction. Rates vary based on a number of factors including industry segment, the card brand, the card type, and how the card is presented (in-person, online, keyed). Note that there are more than 300 Interchange categories in the US, and they vary by each card brand!

An Interchange downgrade results when a transaction doesn’t meet the minimum requirements for the target Interchange category and is therefore reclassified to a higher rate category or tier, which results in a more expensive transactional cost for merchants. Though many are avoidable, they are unfortunately common since some providers intentionally allow customers to continue to experience downgrades because, based on their pricing strategies, they make money in the margins.

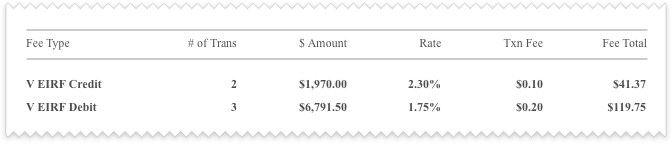

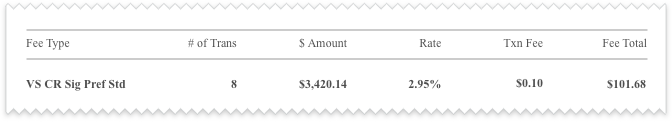

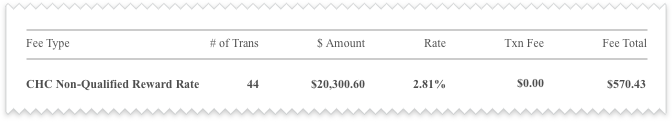

Typically, Interchange downgrades are presented on merchant statements using the descriptors EIRF, Standard or Non-Qual. Here are a few examples:

EIRF

Standard

Non-Qual

Note: Non-Qual downgrades associated with Tiered Rate programs require a report to obtain transaction details

Now, let’s explore what causes downgrades and how to prevent them.

Why Do Interchange Downgrades Occur?

How you run transactions will determine if they will result in Interchange downgrades. The payment software, equipment and processes you use to run transactions are at play. Here are the most common instances that trigger them:

- AVS mismatch (both address and zip code)

- AVS is not run on a hand-keyed, or “forced” transaction

- Batch is not settled within 48 hours of authorization

- Authorization and settlement amounts differ

- Tax is not entered separately from the transaction total

- Tips are not entered separately from the transaction total

- Settled transaction amounts don't match original amounts

- Your terminal software is not up to date

Simply addressing these issues can result in a significant reduction in your processing fees. Here’s how.

Avoid Interchange Downgrades With a Trusted Provider

Since some providers profit from Interchange downgrades, they are not motivated to help you.

Working with a reliable Merchant Account Provider that offers the following operational benefits will greatly decrease the chances of them occurring.

- Choose a provider that offers a variety of pricing programs matched to your needs and provides educational information about the best practices to follow.

- Require AVS on any keyed transaction. A trusted provider should require this feature by default so you never chance an AVS mismatch or forget to run AVS.

- Always enter sales tax and tip amounts separately from the transaction total. This should be easy for you to do with a dedicated provider. The system you enter transactions into should always have separate fields for these amounts.

- Automate daily batches so you never accidentally settle past the 48-hour window, which can trigger a Interchange downgrade.

- Use a Smart Terminal that automatically runs software updates.

Though your rates are important, the equipment and service you receive from your Merchant Account Provider are just as significant. Be wise in choosing who you work with to avoid unethical billing.

Find out if you can reduce Interchange downgrades and start saving.

Does your provider lack any of the techniques above to prevent this? Do you often get downgraded transactions? Tell us more in the comments section.

Editor's Note: This post was originally published in January 2017 and has been updated for comprehensiveness and accuracy.