When a customer visits your business and pays with a credit card, it’s fairly easy to confirm the legitimacy of the purchase. A diligent cashier could ask to see photo ID to confirm that the person in front of her is, in fact, the cardholder. The name and face should match.

However, for card-not-present transactions, merchants must manually key in the credit card number. Verifying the purchaser’s identity is more difficult when you can’t verify it with an ID. Let’s face it: It would be unreasonable to jump on Skype to see each of your online customers’ faces.

With just a credit card number, fraudsters can put charges on a credit card even if it’s not in their possession. To combat this, businesses can implement the Address Verification System (AVS) and Card Verification Value (CVV) to both confirm the authenticity of the purchase and lower their transaction costs. So what are AVS and CVV?

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How CVV and AVS Credit Card Match Help Combat Fraud

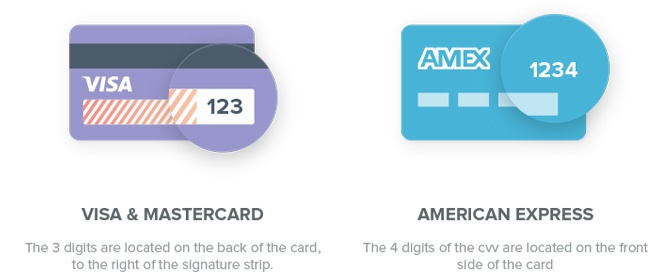

AVS and CVV verify ownership in slightly different ways. With AVS credit card match, a merchant requests the customer’s address and ZIP code. Most point-of-sale systems and Virtual Terminals can quickly verify that the address the customer provided matches the billing address associated with the card. With CVV, a merchant can verify that the customer has the physical card on hand since it requires a code on the back of most credit cards. (This number is on the front of Amex cards.)

Ideally, a fraudster who only has a credit card number won’t be able to pass through AVS and CVV. Merchants don’t need to run AVS and CVV for card-not-present transactions — and it does cost a bit more money to do so — but the potential savings in the event of a fraudulent transaction make it a best practice. And when we say a bit more money, we’re talking $0.01 per transaction (though some unethical providers inflate these rates). It costs only a penny per transaction to protect your business from an array of charges likely to result in a chargeback.

How AVS Credit Card Match Affects Your Rates

Running AVS lowers your Interchange rates. While it costs $0.01 to run credit card AVS, your transactions qualify for lower rates when you use it. Using CVV does not result in a reduction in your Interchange rates.

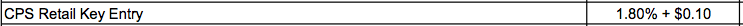

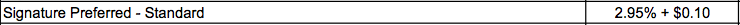

For example, not running AVS on a keyed-in Visa credit card can result in a 64 percent rate increase, according to Visa's Interchange guide.

Regular rate:

Downgraded rate:

The card brands try to limit fraud as much as possible, which is why Interchange rates increase for riskier transactions. By taking a card-not-present transaction and failing to implement any fraud prevention best practices, you’re acting as a bystander. With credit card AVS and CVV, you can catch a good portion of fraudulent transactions, resulting in better rates and fewer headaches for your business.

Were you surprised to learn that an AVS credit card match can lower your transaction costs? Let us know how you protect your business when running card-not-present transactions.

This piece was originally published on February 23, 2017.