Welcome to PJ University, where we teach you how to use PayJunction like a pro. Today’s lesson is how to view batches and bank deposits.

What is a batch? Well, you don’t receive a deposit for every individual credit card transaction that you run. Instead, all of the day’s transactions are grouped into what is called a batch. That lump sum batch is deposited into your bank account when settled.

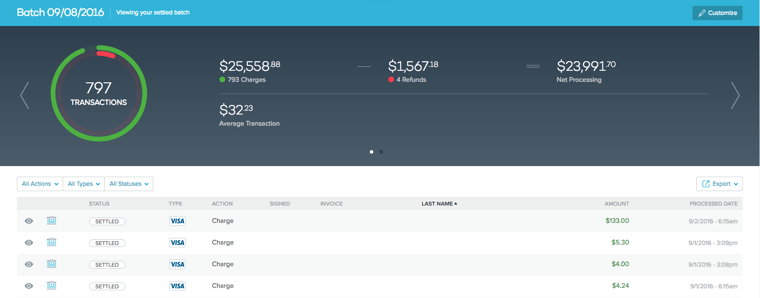

To see your batches, click on “Batches” from the menu on the left. At the top of this page, you will see your current unsettled batch.

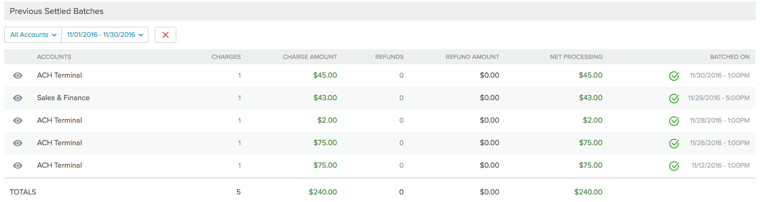

Below, you will see previously settled batches that have been processed and are in route to your bank account. Click on the eye icon to view the details of any batch.

When the page loads, you will see a graph showing the total number of transactions, including charges, refunds, net processing and the average transaction amount. If you click the arrow on the right side of this page, another set of graphs will load. These ones display the percentage of credit card brands used in your transactions. It also includes detailed info, including the number of charges and refunds for all individual brands.

Below, you will see all of the individual transactions in the batch.

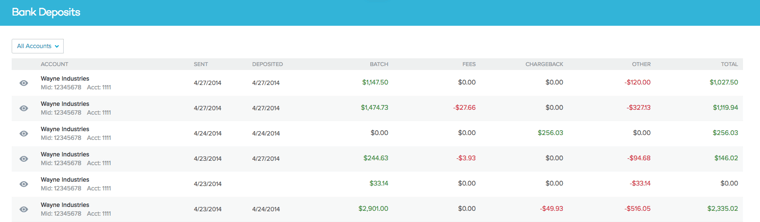

To see deposits to your bank account, click “More” from the menu on the left and then “Deposits” from the sub-menu.

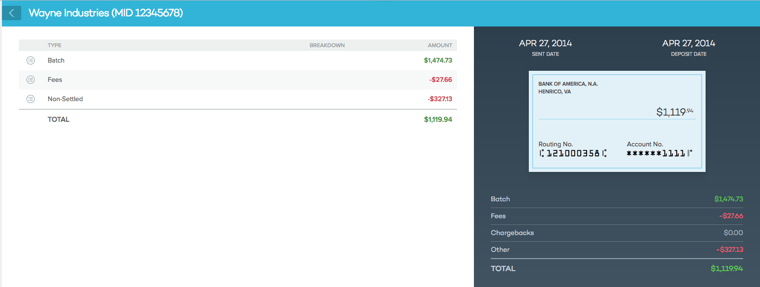

On this screen, you will see the account, the sent date (which is the day the batch was processed with the bank) and the deposited date (which is the day the funds reached your bank account). You will also see the amounts for batches, fees, chargebacks, other and totals.

This report will help your accounting staff verify all deposits and drafts to your bank account. If you would like to see more info about a particular deposit, click the eye icon on the deposit. Here, you will find the details regarding the batch, fees and non-settled transactions.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Quick Bank Reconciliation for Large Businesses

If you have a multi-department or multi-store business, you’re in luck! You can select the department or location when processing transactions and then filter the transaction into the appropriate batch. By doing this, you can see department or location-specific sales totals, which are automatically combined for an aggregate report.

The ability to see your deposits and batches in real time helps you gain a huge efficiency boost over reconciling at the end of the month. Plus, you’re notified of chargebacks faster, which gives you an advantage when fighting disputes. There are eight steps to fighting (and winning) a chargeback dispute. Swift action on your part is key to protecting your business from friendly fraud or chargeback fraud.

If you’re concerned about granting your staff access to deposit and batch reports, don’t be. Our user access controls make it easy to determine what actions and items your employees can access in the system. Batches and deposits can be restricted to appropriate team members.

Want more product information? Subscribe to our newsletter!

We thank you for completing this lesson! Get notified of future PayJunction University posts by subscribing to our blog.