At PayJunction, we provide a detailed breakdown of our customers’ bills each month, which we’ll show you how to read below. For customers on Tiered pricing, transactions fall into three or four price tiers dictated by the risk or reward associated with the transaction — the higher the risk (e.g. keying in a transaction) or reward (e.g. an airline miles card), the higher the cost.

The major benefit of Tiered pricing is its easy-to-understand structure. In the processing-details section of our merchant statements, you can see which tier each transaction falls into and the corresponding rate applied.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Understanding Tiered Merchant Statements

Every PayJunction merchant statement is broken into five categories:

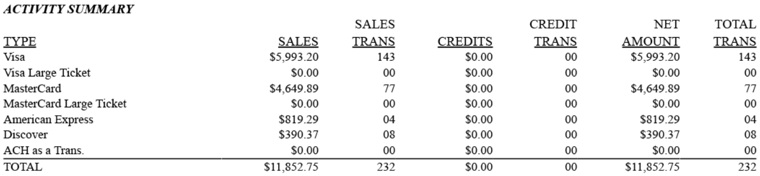

- Activity Summary: This first section covers the total volume processed for the month, which is broken down by payment type. If any refunds are processed, the volume is listed here as well.

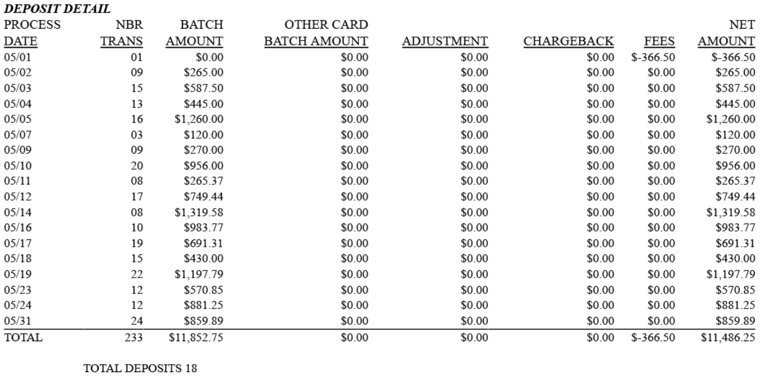

- Deposit Detail: The volume per batch is detailed in the second section. Of course, this information can be accessed in real time through our Virtual Terminal, but it is always listed on the monthly merchant statement for reference.

If you have a direct merchant account with American Express, all Amex volume is listed in the “Other Card Batch Amount” column. The deposit detail section also lists the previous month’s fees as a debit, which is -$366.50 in the example above.

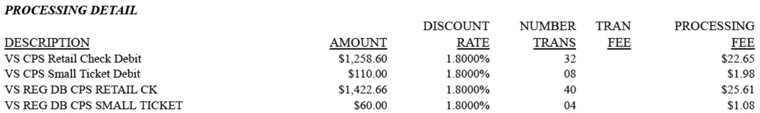

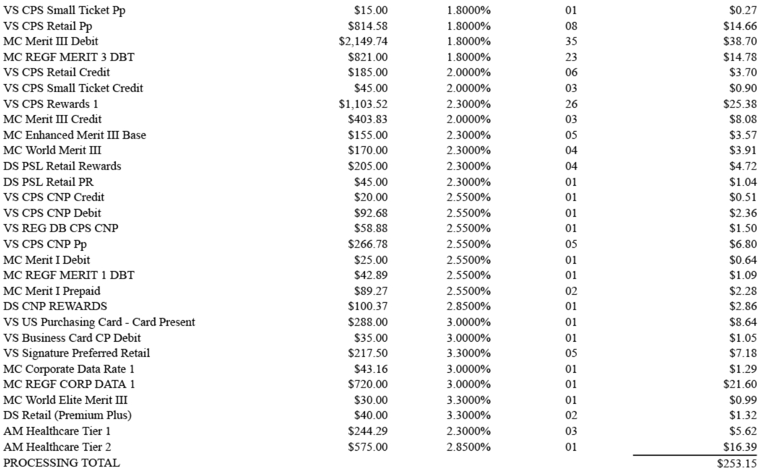

If you have a direct merchant account with American Express, all Amex volume is listed in the “Other Card Batch Amount” column. The deposit detail section also lists the previous month’s fees as a debit, which is -$366.50 in the example above. - Processing Detail: This section lists the volume per payment type and associated costs, going into more detail specific to Tiered pricing. The exact card type, which is categorized by the corresponding brand’s Interchange guide, is listed along with the corresponding rate applied to the associated volume.

This particular statement features the following Tiered rates:

- Check Qualified (Debit) = 1.80%

- Qualified = 2.00%

- Qualified Rewards = 2.30%

- Mid-Qualified = 2.55%

- Mid-Qualified Rewards = 2.85%

- Non-Qualified = 3.00%

- Non-Qualified Rewards = 3.30%

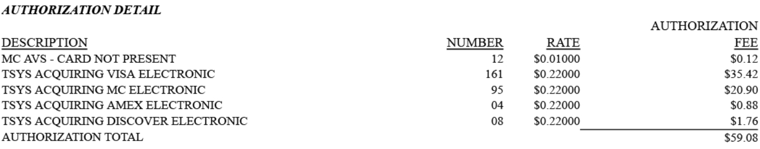

- Authorization Detail: All authorizations (aka transactions) and associated fees are listed here. An authorization fee is a flat-cent fee applied to every transaction.

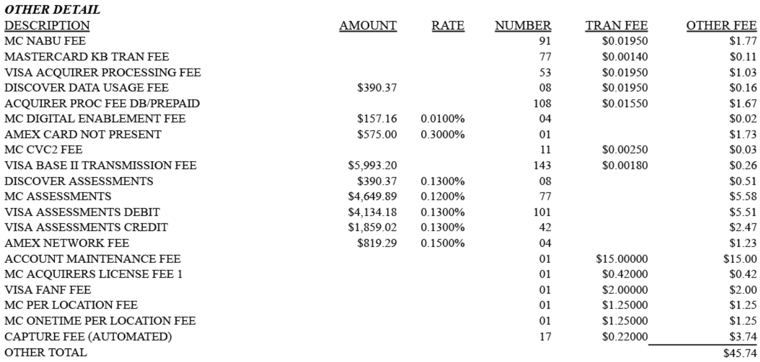

- Other Detail: The last section includes any monthly or annual service charges, batch fees (labeled as “Capture Fee”) and various processing costs also referred to as pass-through fees.

Other Merchant Account Providers tend to group assessment fees, which are determined by the card brands (Visa, MasterCard, Discover and Amex) and paid directly to them, into the Tiered rates. We break these out and list them separately for a clearer picture of what you’re paying and where it’s going.

Other Merchant Account Providers tend to group assessment fees, which are determined by the card brands (Visa, MasterCard, Discover and Amex) and paid directly to them, into the Tiered rates. We break these out and list them separately for a clearer picture of what you’re paying and where it’s going.

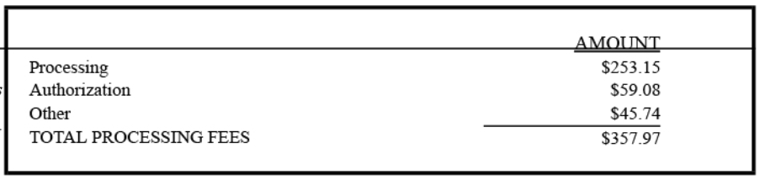

A summary is provided at the end of every statement with the processing, authorization and other totals, along with a sum for the month’s billing cycle.

You can view the complete merchant statement on Tiered pricing here.

You can view the complete merchant statement on Tiered pricing here.

Want more payment insights? Subscribe to our newsletter!

Do you have any remaining questions on how to read our Tiered merchant statements? Let’s start a conversation below.