-

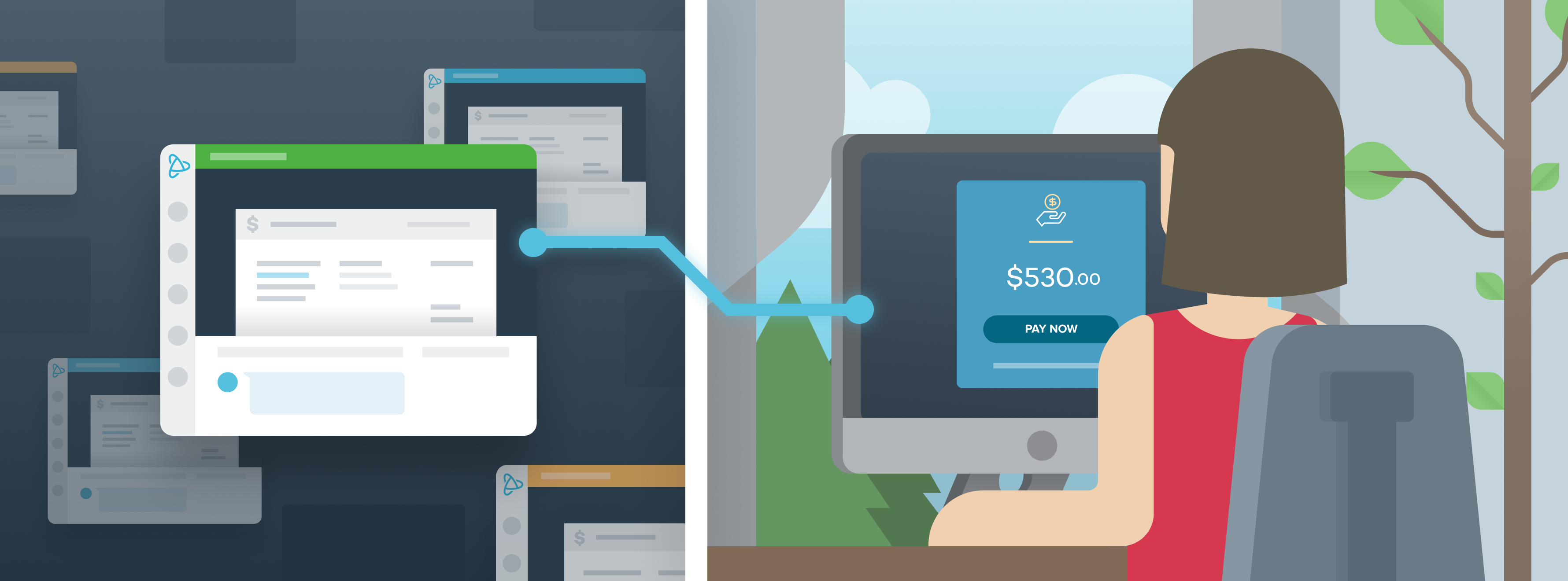

How to Send Invoice Payment Requests Effectively in Minutes

When business is moving quickly, sometimes you can’t afford to wait weeks (or even days) to get paid. It's time to say goodbye to inefficient paper invoices and hello to a steady cash flow. With modern invoicing features, like secure payment requests via email and text or automated recurring invoices, professional invoicing can streamline operations, reduce customer friction, and speed up access to working capital. In this article, you'll learn everything you need to know about invoicing best practices, payment options, templates, and real-world use cases.

READ MORE -

Understanding and Managing Chargebacks at Automotive Dealerships

Automotive dealers know that successful transactions are critical for revenue, customer satisfaction, and trust. However, an increasingly familiar challenge dealers face is managing chargebacks: the financial reversal of a credit card transaction initiated by the cardholder’s bank. While often valid, chargebacks can also result from customer misunderstandings or fraudulent activity, creating financial strain and administrative headaches for dealerships.

READ MORE -

Printed Receipts: The True Cost

If you’re like most business owners, you store every printed receipt from your credit card terminal and provide copies to your customers. It may be a routine you consider a best practice to protect your business, but the cost to maintain and store printed receipts significantly eats into your profits.

READ MORE -

5 Benefits of Signature Capture

Collecting a signature for a payment is pretty straight forward, right? You print a receipt, the customer signs it, you file the signed receipt and you’re done. Sure this works, but there are so many downsides to collecting signatures on paper receipts, including chargebacks, costs and damage to the environment.

READ MORE -

Obtain Non-Payment Signatures With PayJunction’s Smart Terminal

Although the card brands have recently revised their requirements around signature authorization, signatures are still the best defense in the event of a chargeback dispute as long as you’re properly processing your payments. Additionally, there are numerous instances when businesses require non-payment signatures from customers. These include terms and conditions, disclosures, disclaimers, liability waivers, privacy agreements, HIPAA agreements, warranties, etc. In the medical industry alone, this can amount to dozens of forms related to billing, on-boarding, consent, prescriptions, lab reports and care agreements that must be physically stored or scanned and stored online.

READ MORE -

4 Benefits of Using Electronic Receipts at Your Dealership

I’m sure you wouldn’t argue that more paperwork is a good thing at your dealership. It’s difficult to organize and maintain tons of paperwork, and it may feel like there’s no escape from it. It’s simply part of the job.

READ MORE