There are a few payment processing rate plans you can choose from, which vary depending on who you decide to work with. In the unfortunate event you work with an unethical Merchant Account Provider, you may end up on Billback or worse, Enhanced Billback.

You may hear a few different terms for Billback, such as Enhanced Recover Reduced, blended rate or mixed rate. Regardless, any variation of Billback is bad for business, no matter how appealing it may seem. What’s worse, these rate plans are so confusing you may be on some variation and not even realize it.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

What Is Billback?

It breaks down like this:

- Your provider proposes a flat rate, for example 1.79%

- You’re charged 1.79% on every transaction on that month’s statement

- Your provider later reviews those transactions and determines which did not qualify for the Interchange cost proposed

- You’re charged the difference to make up for the true cost of the non-qualifying transactions on the following month’s statement

Interchange varies depending on the card type and transaction method, so not all transactions have the same wholesale cost. Your provider banks on you not knowing this so you think you’re paying one rate for all transactions you take.

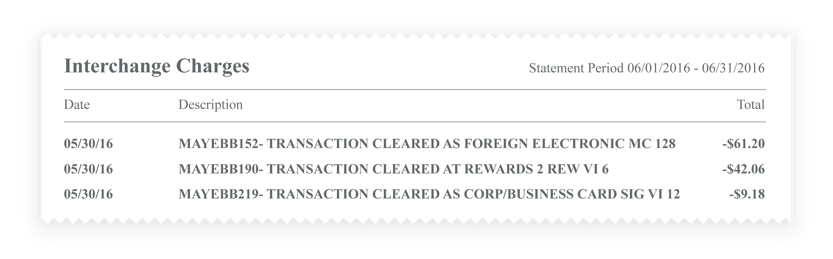

On statements, Billback is typically denoted as BB in the description, sometimes ERR for Enhanced Recover Reduced. The month of the original transaction is usually in the description, as well.

Note: The statement period is for August, but the transactions are from July.

The processing volume and fee breakdown (authorization fee ($) x number of transactions) are intentionally left out on the following month’s statement so you can’t determine the rate you are paying for the markup. Without two consecutive statements, there is no way to see the true rates paid.

Even with both statements side by side, there isn’t enough data provided to determine the rate on the BB line items in the second statement.

Confusing? You bet. Necessary? Absolutely not.

Enhanced Billback

Don’t be fooled by the slight name change, Enhanced Billback is actually much worse. Here’s how it works:

- Your provider proposes a flat rate, for example 1.79%

- You’re charged 1.79% on every transaction on that month’s statement

- Your provider later reviews those transactions and determines which did not qualify for the Interchange cost proposed

- You’re charged the difference to make up for the true cost of the non-qualifying transactions on the following month’s statement, along with a hidden markup

So in addition to paying more than you were promised, you’re also paying a markup just because your provider can easily add it into complex statements.

The transaction descriptions denote EBB, along with the month the transactions originally ran:

Note: The statement period is for June, but the transactions are from May.

Like we said before, even with two consecutive statements, there isn’t enough info to determine the rate. What’s worse? For EBB, it’s actually impossible to know if the items have a hidden fee — which usually means they do.

Pay What You’re Promised

Unethical providers will promise you an appealingly low rate but fail to mention what’s to follow. Don’t be fooled; these plans are the least transparent. Check your statements for the description details that include volume and number of transactions on line items.

If these key pieces of information are missing, then your provider is hiding fees from you. Get a professional analysis if you're unsure whether you're on some variation. If you don’t fully understand your rate plan, there’s a good chance you’re in the dark about certain fees.

Are you surprised by this rate plan? Are you questioning whether you’re current rate plan is some variation of Billback? Don’t hesitate to share your thoughts and start a conversation below.

Editor's Note: This post was originally published in January 2017 and has been updated for comprehensiveness and accuracy.