It’s said there’s no such thing as a free lunch, and the adage definitely holds true for the payments space. Whenever a service is rendered, it generally comes at a cost, which is why Merchant Account Providers charge monthly minimum fees.

In brief, a monthly minimum fee is imposed on a business when it doesn’t process sufficient volume to cover a predetermined amount in processing fees. It essentially guarantees payment on the account. Only processing fees paid to your provider count toward the minimum, as opposed to fees to your gateway, fees related to chargebacks, etc.

While low rates may appeal to small businesses processing low transaction volumes, rates that are too good to be true can be just that, given how minimums vary by provider, as do the processing fees that count toward it.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How Your Rate Plan Affects Your Monthly Minimum Fee

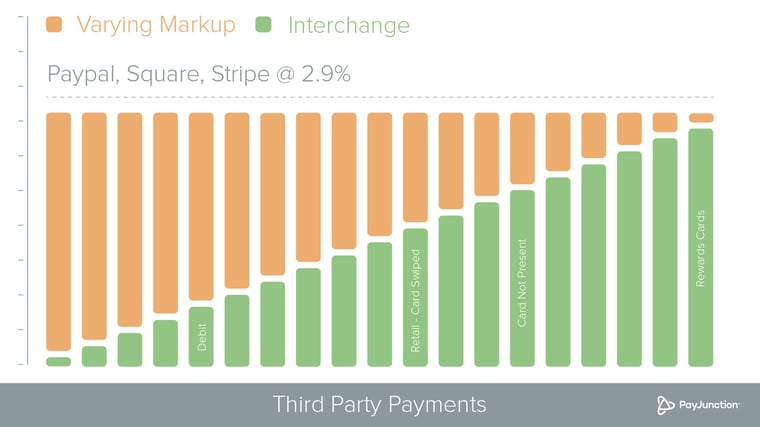

On any given transaction, businesses on an Interchange-plus pricing model pay Interchange (the wholesale cost dictated by the card brands) plus a consistent markup set by the provider. Some providers count the entire processing cost (Interchange and markup) toward the minimum, while others may exclude Interchange and count only the markup.

.jpeg?width=760&name=Interchange-plus-rate-1%20(2).jpeg)

Ideally, monthly minimum fees make up the difference between an established monthly minimum and the amount garnered from processing fees. For example, if the fees for a given month total $14.50 but the minimum is $35, the monthly minimum fee will be $20.50.

Businesses that run $5,000 and more in monthly transactions generally manage to avoid monthly minimum fees, but small or seasonal businesses on an Interchange-plus rate plan encounter them more frequently. To avoid this, lower-volume businesses might consider a Flat Rate plan.

Offered by Payment Facilitators like Square, Stripe and PayPal, Flat Rate pricing comes with higher processing fees. That said, customers bypass minimums because they don’t have individual merchant accounts. Instead, Payment Facilitators lend their customers shared merchant accounts. This approach comes with its own host of drawbacks, but can be more appropriate for low-volume businesses.

It’s recommended that you keep track of your monthly minimums, account stipulations and merchant account statements to prevent any unethical billing practices from taking place. This will help you determine whether your provider is charging you fairly and whether you’re on the best rate plan for your business.

Take a look at your monthly merchant statements. Does the monthly fee listed add up? Let us know what you're seeing in the comments section below.