There are a number of payment providers that enable you to accept credit cards. Whether you interact with them directly or not, there are a handful of fees you have to pay for the privilege of accepting plastic.

Some fees, like Interchange, cover the wholesale cost of accepting a given transaction. Others are charged monthly, quarterly or annually. We’ll detail how Interchange works and various fees that can factor into your credit card processing costs. There is no right answer here, so it’s best to understand which fees come directly from the card brands versus which are dictated by your providers.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

What Is Interchange?

As noted, Interchange is the wholesale cost of running a transaction. It is set biannually by Visa, MasterCard, Discover and Amex to reflect the risk and reward of a given card. As these factors go up, so too do the costs.

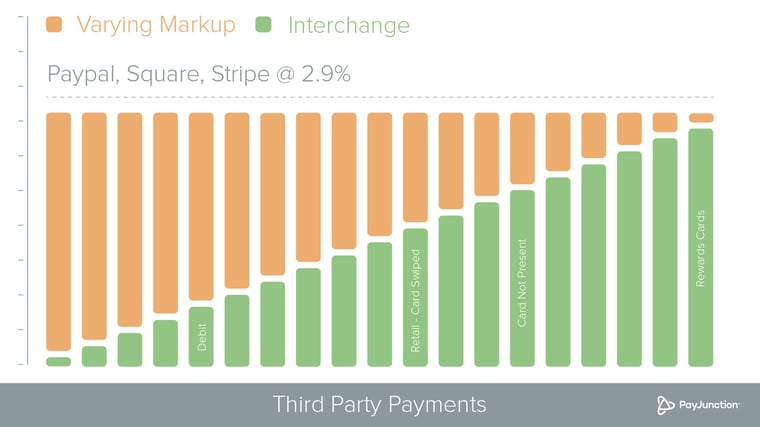

If you accept credit card payments, you’ll be billed by your Merchant Service Provider for the Interchange cost plus a markup. If you have Flat-rate pricing, that markup will vary wildly as this rate plan charges the same rate for every transaction, regardless of its Interchange rate.

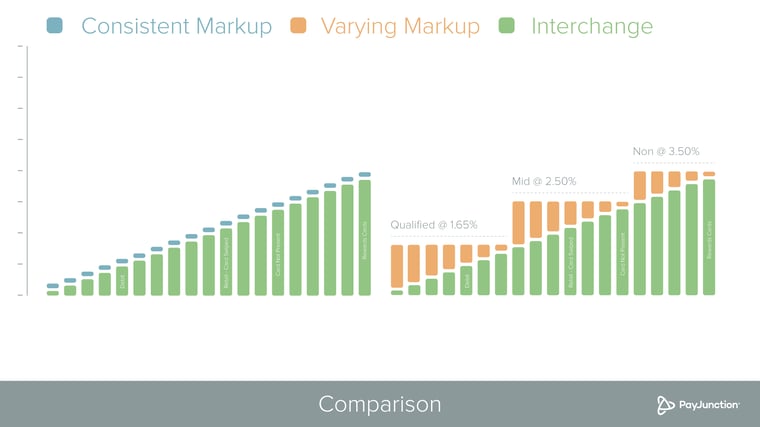

With a Tiered or Interchange-plus plan, the markup will be smaller as these rate plans do factor in risk and reward levels. In the case of Interchange-plus, you simply pay the wholesale price plus a consistent markup; with Tiered, your transactions are bucketed into one of three levels.

While some providers may offer lower rates in terms of basis points, you should be cautious of too-good-to-be-true deals and pay attention to the effective rate. Your effective rate can be calculated by dividing your total processing fees by your total monthly credit card volume. There are a number of fees that providers may or may not charge that will impact your effective rate.

Standard Monthly Fees

On top of Interchange and your markup, you’ll be charged various standard monthly fees. These will vary by provider:

- Monthly Fee: Many providers charge monthly fees to cover the basic use of the provider’s services.

- Monthly Minimum Fee: This fee should only be charged if your monthly processing fees are below the agreed-upon minimum.

- Processing Commitment Fee: Similarly, this fee may be charged if a month’s processing falls below the agreed-upon volume.

- Payment Gateway Fee: This fee is charged for the use of a Payment Gateway to aid in the transaction process.

- Statement Fee: This fee covers the costs of printing and mailing your monthly merchant statements and can typically be avoided by opting for electronic statements.

- AVS: If you take over-the-phone or e-commerce purchases, you should run AVS as a fraud-prevention measure. AVS incurs a $0.01 per-transaction fee. This fee is sometimes manipulated by providers to make more money off your account, so double-check your statements to ensure you’re paying the true cost.

- Batch Fee: Every batch (group of transactions) that’s settled may incur a fee of $0.05 or $0.10.

- Assessment Fees: The card brands charge dues and assessment fees, which are passed down to businesses. As of this publication, these fees should never exceed between 0.11% and 0.13% for Visa, MasterCard and Discover assessments or 0.15% for Amex. These rates are subject to change biannually when the card brands update their Interchange guides.

Fees That Impact Your Credit Card Processing Costs

As you shop around, you may find yourself comparing two providers. Let’s say Provider A offers a rate of 0.75% + $0.10 over Interchange while Provider B offers a rate of 0.50% + $0.10 over Interchange.

It seems like Provider B is the clear choice, right? While you may be correct, there are a host of common fees that some providers charge and others don’t. We recommend requesting a sample billing statement from the providers you’re considering in order to determine your effective rate.

While some fees are par for the course and cover the true services rendered, others can be questionable. Here are some fees that can increase your credit card processing costs and that serve as red flags that your provider may be shortchanging you.

- PCI Fee: Some providers charge their customers PCI fees for not being compliant with the Payment Card Industry Data Security Standards. This fee isn’t passed down by the card brands and doesn’t help your business achieve compliance.

- Bank Service Fee: This fee sounds legitimate because it’s so vague, but it serves no purpose and covers no cost for your provider.

- Auto-Renew Clause and Early Termination Fee: Contracts with unsavory terms can make it incredibly painful to switch providers. We recommend that you review your existing contract for such terms and keep an eye out for them if you’re searching around.

- Excessive Downgrades: Similarly, if you see the term “EIRF” on your statements, you’re suffering from downgrades, which is when a transaction is categorized to a higher Interchange rate because of incorrect processing. Many reasons for downgrades are easily addressed with the right guidance, but many providers would rather profit than correct bad habits.

- Inactivity Fee: This fee is sometimes charged if you fail to run a transaction within a given time frame, typically a day or two. It isn’t related to your total processing volume.

- Non-Qualified Interchange: This is a fake fee that sounds legitimate because it borrows terminology from one rate plan and applies it to another.

- EMV Non-Compliance Fee: Some providers don’t offer EMV-certified processing terminals but still charge their customers a fee for not being compliant.

- Billback: If you see BB or EBB on your statements, you’re on Billback. This rate plan makes it impossible to know your effective rate.

- Next-Day Funding Fee: Receiving next-day funds is standard and shouldn’t result in a fee.

- Tax-Reporting Fee: Your provider is legally required to report your revenue, so no fee should be charged.

Because merchant statements are so complicated, it’s easy and common for providers to add in bogus fees simply to make money off your account. Looking at a sample statement will give you a sense of which fees the provider charges and whether any are illegitimate.

Have further questions about credit card processing costs? Ask them in our comments section below.