If you’re on an Interchange-plus rate plan, you pay the wholesale cost to run a transaction (known as Interchange) plus a provider markup. The wholesale cost is determined by the card brands (Visa, MasterCard, Discover and Amex) and accounts for the risk or rewards associated with the card.

If you’re processing a relatively consistent volume from month to month, say $35,000 in April and $34,500 in May, you might expect your merchant statements to be similar. Sometimes that’s the case; sometimes it’s not. Why? Because the percentage of your aggregate volume for a given card type influences your Interchange rates (as do other factors like downgrades). Focusing specifically on card types, here are four questions to ask yourself when you see your effective rate fluctuating on wholesale pricing.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

What Percentage of My Volume Was Amex Cards?

Although Interchange rates vary by card type and go up as risk and reward increase, Visa, MasterCard and Discover all charge similar rates for their card types. Amex, however, is more expensive. Even if your aggregate volume is the same month to month, a 5 percent increase in your Amex transactions relative to your Visa, MasterCard and Discover transactions could increase your merchant statement by 0.10%.

If you accept Amex transactions, check to see whether your Amex processing has increased relative to the other major card brands. The more Amex cards you take, the higher your effective total bill will be for the month.

What Percentage of My Volume Was Debit Cards?

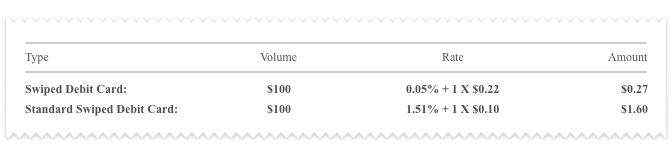

The Durbin Amendment, part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, regulated signature, PIN, card-present and card-not-present debit card transactions to $0.21 (plus $0.01 in some cases for fraud prevention) plus 0.05%.

Because of the Durbin Amendment, a $100 transaction on a credit card could cost $1.60 in processing versus just $0.27 on a debit card.

In two months with an aggregate volume of $50,000, a 16 percent decrease in debit cards would increase your effective rate by at least 0.21%.

What Percentage of My Volume Was Rewards Cards?

The same reason for a fluctuation with debit cards is also true for rewards cards, but the change is less extreme. When you hear about a rewards card offering 1% cash back, someone has to pay for the rewards. A card that offers 3% in cash-back rewards costs even more to process, but the difference between rewards cards is smaller than between a debit and a rewards card.

Look at the types of rewards cards you’re accepting. Did your aggregate volume for rewards cards go up? Or did higher-reward cards increase relative to those offering lower rewards?

What Percentage of My Volume Was Foreign Cards?

Dues and assessments are fees charged by the card brands to cover network operations, price and rule setting, marketing expenses, and research and development into fraud-prevention technologies. Dues and assessments should never exceed the card brands’ posted rates, which are 0.11% - 0.13% for Visa, MasterCard and Discover, and 0.15% for Amex (as of April 2017).

Some unethical providers pad these fees to make an extra profit, but foreign cards also carry higher dues and assessments. Processing can differ by upwards of 1% solely because the card was issued internationally. You can spot foreign cards rather easily on most merchant statements. They are usually noted separately at the bottom of the month’s merchant statement.

By looking for these four ways card types impact your merchant statements, you can usually spot the reason for a fluctuation in your merchant statement. Other factors like whether you’re collecting AVS on card-not-present transactions or whether you’re batching within one day of transaction processing can also impact your rates (although these habits tend to be more consistent).

If your percentages by card type and aggregate volume are consistent, it might be worth a professional statement analysis to identify whether any unethical billing is occurring.

Have you experienced big changes in your monthly merchant statements on Interchange-plus pricing? Have you spotted higher-than-stipulated dues and assessments on your merchant statements? Share your experiences in the comments section below.