When seeking an answer to this question, it’s vital to know that no two credit card processing statements are exactly the same. Statements vary among providers in regard to how sections are labeled, the order they appear in, the names — and shorthand — of different fees, etc.

For this reason, we’ll provide a general overview of how to read a credit card processing statement so that you know how things are typically displayed. If you’ve yet to sign up with a Merchant Service Provider or are considering a switch, we recommend asking to see a sample billing statement to gain a full understanding of how to read your credit card processing statement before signing up.

These documents, which denote all fees accrued for your acceptance of credit cards, are complex, which makes it easy to alter them to your business’s detriment. Knowing what you’re looking at is the best way to advocate for your business.

How to Read a Credit Card Processing Statement

In general, credit card processing statements feature four sections: processing summary, deposits, markup and auths, and pass-through fees. If your business is on Interchange-plus pricing, there will be a section that details these rates, as well. On top of these, you may see additional sections such as “other fees.” But, due to the variability of merchant statements, we’ll start with these fees and provide real examples.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

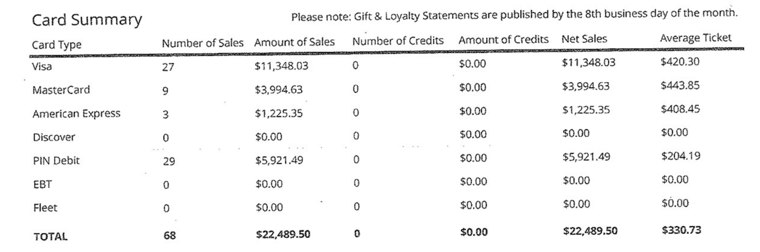

Card Summary

So, from top to bottom, you’ll likely first see a section detailing your credit card volume for the month. It may be labeled “Card Summary.” In this section, you’ll see your total transactions by card brand (e.g., Visa, MasterCard, Discover, etc.), the total dollar value of those transactions, any refunds and chargebacks, and the average ticket value per card brand.

This section gives you a high-level overview of your total transactions, but it’s important to note that while your net sales may not change month-to-month, you may experience differences in costs due to Interchange fluctuation. In other words, certain transactions, like Amex transactions, carry a higher cost, whereas others, like PIN debit, are cheaper to process. So, the more Amex you accept, the higher your fees will be. More debit transactions will have the opposite effect.

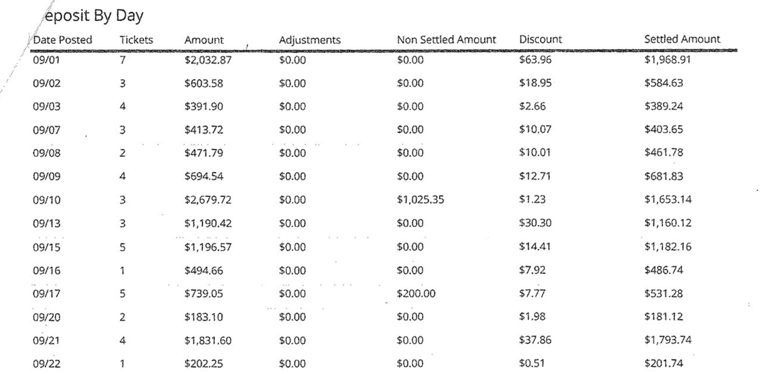

Deposits by Day or Month

Monthly discount is more common than daily discount. Monthly discount refers to a merchant account setup in which your fees are taken out once at the end of the month. Daily discount refers to when fees are taken from each day’s deposit. In this example, the merchant is on daily discount. Regardless of which setup you have, you’ll see your deposits noted, along with fees that were removed and your final, settled amount.

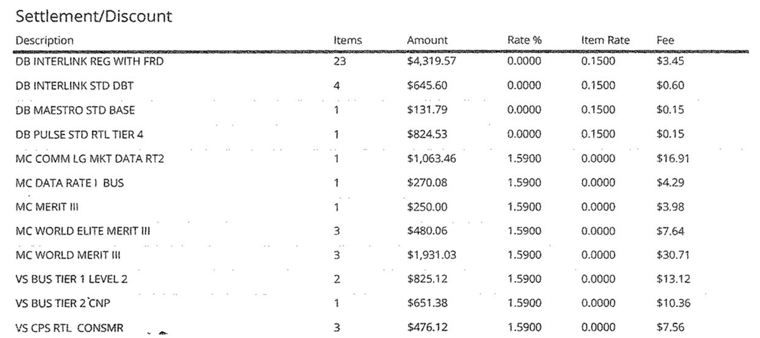

Interchange-Plus Rates and Auths

Typically this section will come next, but only if you’re on Interchange-plus pricing. On an Interchange-plus pricing plan, a merchant simply pays the Interchange (or wholesale) cost of each transaction plus a standard markup.

The Interchange rate for every transaction varies with risk and reward and is set by the card brands. As the risk or reward increases, so too does the cost to process the payment.

Regardless of payment plan, you’ll also see the cost of your auths here. Typically, providers charge an authorization, or “auth,” fee for every attempted transaction, regardless of whether they’re successful or result in a refund, void or chargeback.

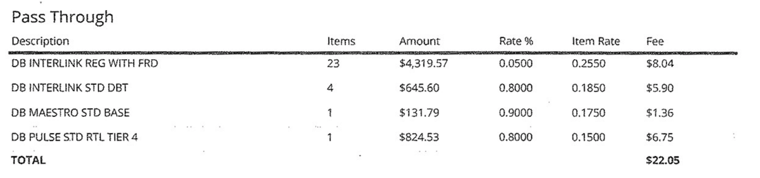

Pass-Through Fees

Payment providers charge a number of pass-through fees that enable your acceptance of credit card transactions, even if they do not interface directly with your company. Payment Gateways and Payment Processors are middlemen that fit this description.

You’ll see these noted as pass-through fees, meaning they were charged to your Merchant Service Provider and are now being passed onto you.

Dues and assessments are a common pass-through fee from the card brands, and we recommend you familiarize yourself with them. These rates are part of the card brands’ aforementioned Interchange guides and therefore shouldn’t exceed the advertised rate. MasterCard, Visa and Discover dues and assessments are currently set between 0.11% and 0.13%, and Amex’s are set at 0.15%.

Again, this is simply an overview of how credit card processing statements are typically displayed. Have anything to add or questions to ask? Note them in the comments section below!