There are a number of factors to consider when setting up your merchant credit card processing. Which Merchant Account Providers are trustworthy? Which one offers the best product? Which one will treat you like a valued customer?

Once you’ve chosen a provider, there are even more decisions to make. What equipment does your business need? Who should you delegate tasks and account access to? Which rate plan should your business be set up on?

Working with a trusted provider will ensure that your merchant credit card processing — and your rate plan — is configured to fit your business needs. If a Tiered rate plan is the best fit, you’ll want to ensure that you’re set up on the right Tiered pricing plan from the get-go. That’s right, there are two types of Tiered pricing structures.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Tiered Pricing: MOTO vs. Retail

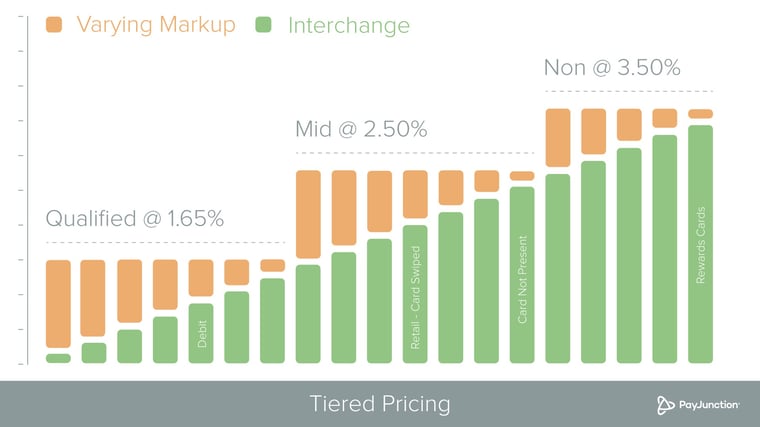

Understanding what you’re paying for on a Tiered pricing plan is relatively easy. Rates are bundled into three or four tiers, each with a sub-tier for rewards cards. These bundles make reading your merchant statements straightforward.

Depending on how your business processes transactions, you should be set up on either a MOTO or retail Tiered pricing structure.

MOTO, which stands for “mail order telephone order,” is for businesses that take the majority of their payments over the phone. This could be e-commerce businesses or retail locations that mostly processes card-not-present transactions.

MOTO transactions typically cost more because keyed-in transactions run a higher risk. Why? Keyed-in transactions are more susceptible to fraud. Luckily, partnering with a trusted provider will help keep these fees at bay by enabling all fraud-prevention settings on your merchant account.

Retail Tiered pricing is for businesses with a majority of card-present transactions. This rate plan is less expensive than MOTO because swiping or dipping credit cards is safer. So, why are we making such a fuss over these two very obvious, different rate plans?

Implications of Incorrect Tiered Pricing Setup

If you have an e-commerce business set up on a retail Tiered account or a retail business set up on MOTO, you’re going to run into problems.

A MOTO Tiered account doesn’t have a Check Qualified tier, which is the lowest possible rate for debit cards. So, if your retail business is set up on MOTO, you won’t have access to the lowest rate and will end up paying a higher rate for debit cards.

Similarly, if an e-commerce business is set up on a retail plan, the keyed-in transactions are going to downgrade to a more expensive tier because they’re considered riskier transactions for a retail plan.

Being set up on the wrong plan can also put your business at risk for chargebacks. In either scenario, both the issuing banks and the card brands are expecting the majority of transactions to be run by the corresponding payment method. If they see the opposite for the majority of your transactions, you’re likely to receive chargebacks with a reason code of “card-present environment” or “card-not-present environment.”

Confirming which Tiered pricing plan you’re on may seem minuscule compared to all your other to-dos when setting up your merchant credit card processing, but ensuring it’s set up properly from day one will save your business money in the long run. Be honest with your provider about how you take payments and don’t hesitate to double check the setup on their end.

Have you been issued chargebacks because your Tiered rate plan was set up incorrectly? Did you know there were two types of Tiered pricing structures? Let us know in the comments section below.