Sen. Richard J. Durbin’s (D-Ill.) introduction of Regulation II as a last-minute addition to the Dodd-Frank Wall Street Reform and Consumer Protection Act was well-intentioned and logical from a payments perspective. Interchange — the wholesale cost to run a credit or debit card transaction — is set by the card brands (Visa, MasterCard, Discover and Amex). Interchange should be proportional to the risk of a given transaction, however, businesses were paying upwards of a 1% to 3% Interchange for swiped debit card transactions — one of the least risky transaction types — before the Durbin Amendment was passed. With a card-present debit transaction, the cardholder can be verified and sufficient funds confirmed before the transaction is processed. Credit isn’t even involved.

So, from a retail and business perspective, the Durbin Amendment was a win (in theory) for adjusting the Interchange on debit cards to a more reasonable rate relative to higher risk credit card and card-not-present transactions.

It seemed like a win for consumers as well. If costs were lowered for businesses, surely the savings would be passed down to shoppers in the form of lower prices.

This is where the in-theory stipulation bears repeating.

Throughout his campaign, President Trump made it clear he would fight to undo the many post-recession measures of former President Obama’s administration. Trump said he’d “do a big number” on Dodd-Frank — and subsequently the Durbin Amendment — which could include total rollback or piecemeal removal.

It’s not hard to find arguments citing the Durbin Amendment’s failure to pass savings onto consumers. For many, it exemplifies why the government should avoid price fixing. Although the Durbin Amendment illustrates how good intentions sometimes bear negative consequences, it’s worth unpacking why $42 billion in savings never got passed on to consumers (or even retailers). The answer lies with the secret, unintended profiters of the Durbin Amendment: Payment Facilitators.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How Payment Facilitators Profited From the Durbin Amendment

The Durbin Amendment capped signature, PIN, card-present and card-not-present debit card transactions at $0.21 (plus $0.01 in some cases for fraud prevention) plus 0.05%. Before the Durbin Amendment, a $100 Visa transaction cost $1.59 ($100 x 1.55% + $0.04). Post-Durbin, the same transaction cost $0.27 ($100 x 0.05% + $0.22). That’s about an 83 percent reduction in fees.

Businesses on Interchange-plus pricing saw a big change in their merchant statements because Interchange-plus pricing is regulated — each transaction is simply charged its standardized Interchange rate plus the provider’s consistent markup. These businesses were charged lower rates for debit transactions, achieving the Durbin Amendment’s goal.

However, not every business can be on Interchange-plus pricing. Payment Facilitators — like Stripe, PayPal and Square — only offer Flat Rate pricing. This alternative is popular among small businesses because of its quick setup and lack of merchant underwriting. Because Payment Facilitators provide all their customers with one shared merchant account, they can’t offer custom rates and instead charge a flat rate for all transactions types. To accommodate both low- and high-risk transactions, the well-known Payment Facilitators set their pricing for all swiped transactions as follows:

- Square: 2.75%

- PayPal: 2.9%

- Stripe: 2.9%

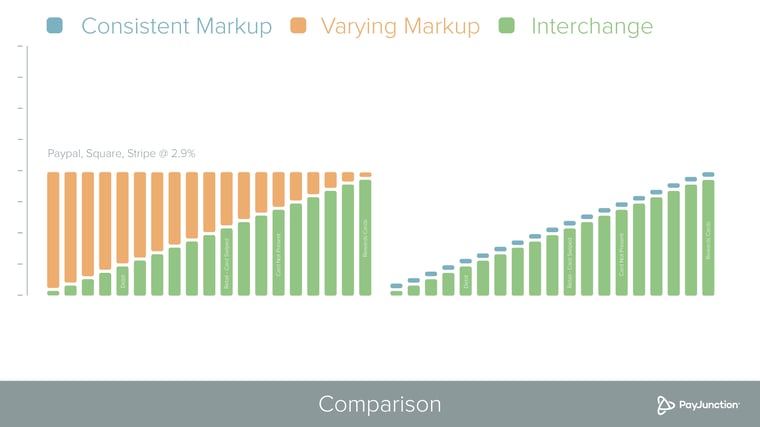

When you look at these rate plans side by side (Flat Rate is on the left, Interchange-plus is on the right), it’s clear that Interchange-plus pricing is more cost-effective for the customer (in this case businesses) because it bypasses Flat Rate pricing’s varying markup that inflates rates to create uniformity.

Despite the Durbin Amendment calling for lower swiped debit card rates, businesses never saw these savings if they partnered with a Payment Facilitator for their credit card processing. Instead, the Payment Facilitators pocketed the savings within their varying markup margins (effectively their profit margins). And because these retailers never saw a difference in their merchant statements, their customers certainly didn’t benefit from passed-down savings.

For businesses on Interchange-plus pricing, the jury is still out regarding why savings weren’t passed onto consumers — or if they were, granular data isn’t available. Meanwhile, community credit unions lost out on $7.2 billion due to Dodd-Frank regulations like the Durbin Amendment, according to the Credit Union National Association.

What Will Change If Trump Repeals the Durbin Amendment

Because of the low risk associated with swiped debit cards, the Durbin Amendment appropriately regulated the Interchange for these transactions. Unfortunately, what — in theory — should have been a win-win for retailers and consumers ultimately only benefited Payment Facilitators who saw an increase in their margins and withheld it.

If President Trump is successful in dismantling the Durbin Amendment, Interchange rates on debit transactions will surely increase. Businesses on Interchange-plus pricing will pay more for swiped debit card transactions, whereas Payment Facilitators could choose to increase their rates to offset higher costs. Across the board, businesses are likely to see their transaction costs go up, resulting in no relief at checkout for consumers and potentially buoyed profits for banks and credit unions that issue credit cards — the intended targets of the Dodd-Frank regulations.

Are you expecting changes in the Durbin Amendment to affect your business? Let us know your thoughts in the comments section below.