Unfortunately, unethical billing is more common than we’d like to believe. Some Merchant Account Providers will squeeze terms and fees into their merchant contracts that only harm the businesses they claim to serve. Due to the nature of these terms, most business owners don’t realize they’re unfairly locked into a contract until they’re looking to exit their merchant credit card processing agreement.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

The Problem With Contracts

There are two contract terms we take issue with:

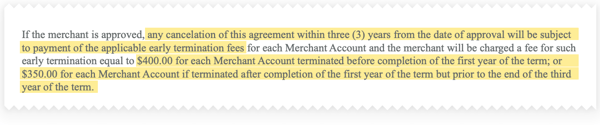

- Early Termination Fee - An early termination fee is charged when you cancel your merchant account before the length of your contract is up. The cost can vary depending on how long you have left in your contract (typically the longer you have, the higher the fee). Providers claim this cost covers the work it takes to shut down your account, but in reality it’s there to deter you from switching providers.

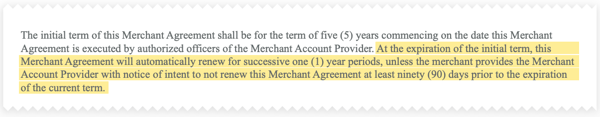

- Auto-Renew Clause - Along with an early termination fee, many providers will include an auto-renew clause in your merchant contract. For some providers, this simply streamlines renewals and a 30-day cancellation notice is all it takes to cancel the contract. However, some unethical providers use auto-renew clauses to force customers to pay their way out, usually based on how much time is left in the contract.

Both terms pose the potential for significant financial losses, and usually result in one of four decisions on your end:

- Pay the early termination fee. Sure, paying is your quickest option, but you’re left with a chunk of change missing from your pocket.

- Keep your account open and find a new provider. If you’re not up for paying an early termination fee, you can leave your account open but discontinue using it. Yes, you’ll have to pay monthly fees to cover the cost to keep it open, but you can search for a new provider that offers enough savings to cover the monthly fees until you can cancel your contract with your initial provider.

- File a lawsuit against your provider. Unethical contracts often lead to lawsuits, such as Federal Trade Commission v. Merchant Services Direct, LLC. The FTC charged Merchant Services Direct for falsely telling businesses they could cancel at any time, along with persuading business owners to sign fine-print, binding contracts that were labeled as applications.

- Refuse to pay. If you refuse to pay an early termination fee, your business could be added to the Merchant Terminated File. This essentially blacklists your business from working with any other Merchant Account Provider. You’re also subject to being hounded by collections agencies, as well as damage to your credit score.

We understand that either filing a lawsuit or refusing to pay simply may not be viable options for you; but, we’re here to help you avoid unethical contract terms to begin with. So, what can you do to avoid them?

Never Worry About Unethical Contract Terms Again

We understand it’s rare for providers to have no contracts at all (which means no sneaky terms or exit fees), but they do exist. Here are some best practices for avoiding unfair contract terms:

- Choose a provider with month-to-month service. This is the best way to avoid deceptive contract terms because you won’t have a contract to begin with! These providers have to earn your business back every month by maintaining a high level of transparency and integrity.

- Research, research, research! Read reviews for potential providers and check their BBB ratings to verify their standing in the business community. Don’t hesitate to read other businesses’ reviews of the provider as well as those published by trusted payment industry sources.

- If you’re opting for a provider with a contract, read it thoroughly. Triple checking the terms of a contract isn’t crazy, it’s smart. Bring up any clause that seems questionable and don’t sign a contract until you are 100 percent happy with the conditions.

Your provider shouldn’t make you jump through hoops for anything, including discontinuing their service. Do your due diligence before settling with a provider to ensure you aren’t left with any surprises in the future.

Have you ever battled your provider to get out of a contract? What sort of fees were you faced with? Start a conversation below.