Address Verification System (AVS) is a common fraud-prevention measure for card-not-present transactions. AVS checks that the purchaser is in fact the cardholder by requesting the address and ZIP code for the card and comparing it to the bank’s records. Presumably, a fraudster would not know this information and would be prevented from making an e-commerce or over-the-phone purchase.

Beyond catching fraudsters, AVS affects your processing rates too.

Why is this the case? The card brands try to account for risk and reward when it comes to processing rates. If either one goes up, so do your rates. By not requesting AVS for card-not-present transactions, you’re not taking advantage of available security measures and are assuming higher risk. To successfully maintain low rates, the address and ZIP code provided by the customer should match the billing address of the card.

AVS is fast and costs little to nothing to run if you’re partnered with an ethical provider. That said, skimping on this security measure can significantly hurt your bottom line. Although a number of factors can trigger downgrades (noted as EIRFs on your merchant statements), we’ll dive into how AVS downgrades in particular can inflate your merchant statements.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

How AVS Downgrades Impact Tiered Accounts

Businesses on Tiered rate plans have their transactions bundled into three tiers based on risk and reward: Qualified, Mid-Qualified and Non-Qualified.

Qualified transactions are less risky and have the lowest rates. Rates for each tier are determined by your provider. By not running AVS on a keyed-in transaction, you can trigger a downgrade to Mid- or Non-Qualified, resulting in higher processing rates.

Here’s an example of an AVS downgrade on Tiered pricing:

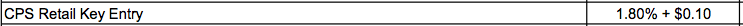

Regular rate:

Downgraded rate:

Both transactions are for the same card type. The first was keyed in with a successful AVS match. The second was keyed in as well, but AVS wasn’t collected. The downgrade resulted in a 17 percent rate increase.

How AVS Downgrades Affect Interchange-Plus Rates

Businesses on Interchange-plus pricing pay the wholesale cost for each transaction plus a consistent provider markup. This wholesale cost, called Interchange, is determined by the card brands (Visa, MasterCard, Discover and American Express). Interchange also varies by card risk and reward.

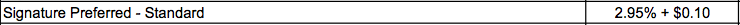

Not running AVS on a keyed-in Visa transaction resulted in a 64 percent rate increase in this example:

Regular rate:

Downgraded rate:

On a per-transaction basis, downgrades might seem minor depending on the card type. That said, businesses processing high transaction volumes can lose thousands of dollars each month by not collecting AVS on card-not-present purchases.

Costs Add Up for High-Volume Businesses

High-volume businesses cannot afford to ignore AVS. Our team of risk analysts review hundreds of merchant statements every month and sees businesses lose thousands of dollars to avoidable EIRFs.

In one example, a business processed $858,443.70 one month but 59.07 percent of its transactions were downgraded. With a markup of 1% on these transactions, this cost the business $3,740.29 in lost profits that month. Extended over the course of a year, this business is losing $44,880 in excessive, unnecessary EIRFs.

No matter how big the business, there’s no sense in spending more on your transactions than necessary. By paying attention to AVS and running it every time on card-not-present transactions, you can save capital for your business. By navigating AVS mismatch appropriately, you can be prepared to defend your business from fraud, reduce payment friction at checkout and secure lower processing rates.

Were you surprised to find out you could be incurring excessive downgrades due to your AVS practices? Did you expect EIRFs to impact your statements this much? We'd love to hear your thoughts in the comments section below.