If your business takes phone and online orders, but doesn’t collect customers' signatures for these transactions, you’re leaving your business vulnerable to chargebacks. If there is a dispute, you can’t prove the customer verified the transaction, so you lose by default. Sure, you might be able to collect a signature by faxing forms but, let’s be honest, that’s just a waste of everyone’s time.

To protect your business against disputed credit card charges, you need to collect signatures for every type of transaction you process. By always collecting a signature, you’ll arm your business with the best chargeback protection.

How to Fight Disputed Credit Card Charges

Though there are a few different ways chargebacks can occur, we’re going to focus on when a customer initiates a chargeback for a legitimate purchase they made but were unhappy with.

When fighting disputed credit card charges, it’s essential to provide clear evidence that the transaction was authorized. The best way to win a dispute is to present the facts. Whether you’re taking an in-person transaction, phone order or online order, a signed receipt verifying the purchase is the single most useful piece of evidence in a chargeback dispute. So, without further ado, we give you a genius solution: remote signatures.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Remote Signatures Minimize Losses From Disputed Credit Card Charges

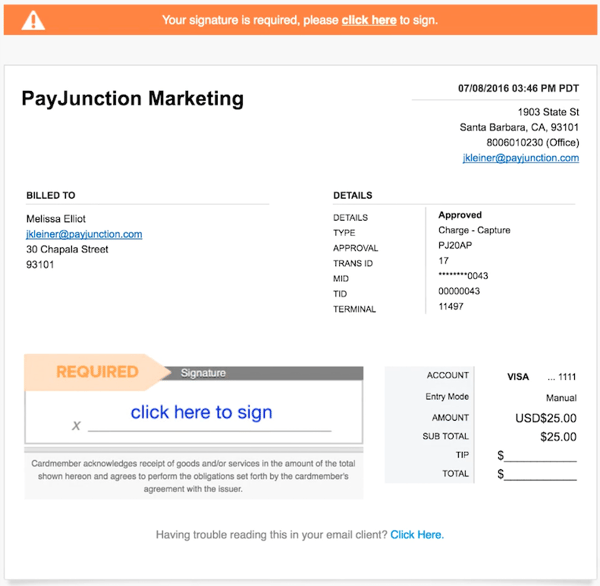

Remote signatures allow you to capture electronic signatures for online and phone orders. With this feature, you’re able to email receipts to customers to sign on their computers or any smartphone.

Once completed, a digital receipt copy is stored in the cloud, so the chance of losing it is completely eliminated. Plus, it’s easily searchable in your system. If there’s a dispute, the signature is readily available so you can quickly contest the chargeback.

Look into Virtual Terminals featuring remote signatures to ensure you’re taking every security precaution. Make sure you have all your bases covered and collect a signature on every transaction you run.

Have you ever lost against disputed credit card charges because you didn’t have a signature on file? Share your experience in the comments section below. We’d love to hear from you!