When it comes to accepting credit cards, we know cost is always a concern for business owners. To fully understand the impact a payment processing rate plan has on your bottom line, you need to understand your rate plan options.

There are three common rate plans: Flat, Tiered and Interchange-plus (IC-plus). Unethical Merchant Account Providers will put businesses on variations of another rate plan called Billback, which we recommend you avoid all together. For the sake of this post, we're going to focus on the three common plans we initially mentioned.

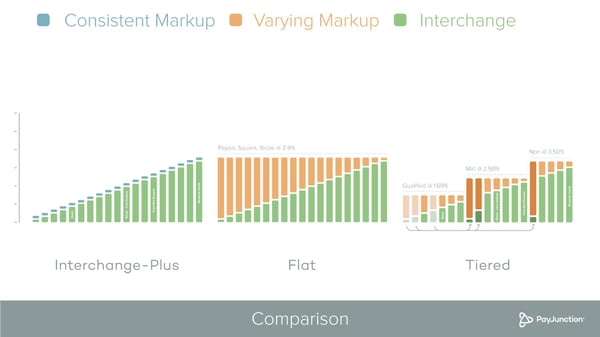

IC-plus offers the best credit card processing rates on the market. But, depending on your processing volume and how established your business is, Tiered or Flat may be a better fit than IC-plus. Here are the pros and cons of each rate plan:

| Transparent | Consistent Fees | Simple | Quick Setup | Small Business | Merchant Account | |

|---|---|---|---|---|---|---|

| Tiered | ||||||

| Flat | ||||||

| Interchange |

| Tiered | Flat | Interchange | |

|---|---|---|---|

| Transparent | |||

| Consistent Fees | |||

| Simple | |||

| Quick Setup | |||

| Small Business | |||

| Merchant Account |

It’s important for you to know that all credit card processing rates start with the wholesale cost (Interchange) to run the transaction, which varies based on card type and method of transaction. This cost is posted by each card brand to its website. Visa, MasterCard and Amex publicly post their Interchange fees. Discover does not.

Now let’s get into the nitty-gritty of each rate plan.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Flat

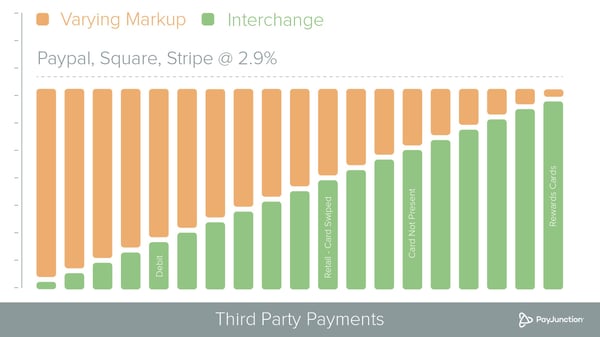

The first thing you should know about a Flat rate plan is it’s not the best credit card processing plan for traditional merchant accounts. Flat pricing is only offered by Payment Facilitators (PayPal, Stripe, Square) who essentially lend out their own merchant accounts to anyone needing to process payments. Because each facilitator works off of a single merchant account, they can’t offer different credit card processing rates to their customers — hence Flat pricing.

Flat pricing is a mix of rates and fees that, together, create one fixed rate regardless of card type or transaction method. Flat pricing is unregulated and often increases processing costs, especially for debit card transactions, as you can see above.

This payment processing rate plan is not the best credit card processing plan for businesses processing high volume. If you run a large transaction or process a high monthly volume, you’re at risk for long-term fund holding. As businesses grow, they tend to move away from Flat pricing plans. However, because Payment Facilitators do not underwrite their customers before on-boarding, Flat pricing is a good option for new businesses looking to start processing transactions right away.

Tiered

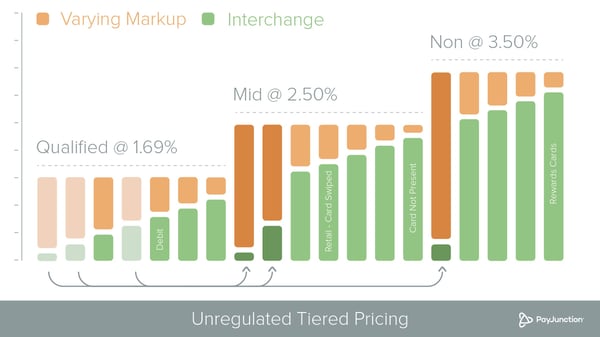

This rate plan bundles transactions into three different tiers (Qualified, Mid-Qualified and Non-Qualified) based on certain criteria. Ultimately, the tier a transaction falls into depends on the level of risk or reward associated with the card. The higher the risk or reward, the higher the cost. This plan isn’t necessarily bad because it’s simple to understand. However, because Tiered pricing is unregulated, some providers will take advantage of this setup and bury excessive markups.

Another downside to this payment processing rate plan: Transactions that don't meet their intended tier criteria can be downgraded to a more expensive tier without notice. For example, if you key-in a debit card but fail to check the Address Verification System, the transaction can downgrade to Non-Qualified, resulting in a higher rate.

The majority of businesses are on Tiered rate plans, so odds are you’re on one too. Though a Tiered rate plan is simple on the surface, it makes it very difficult to understand your provider's fees and determine which tier you should truly be paying.

Given the lack of regulation, your provider has free range to shift transaction types into any tier. That means more expensive transactions for you, and a larger profit for your provider.

Interchange-Plus

This is the most transparent credit card processing plan with clearly outlined fees and terms. IC-plus is a combination of the wholesale cost to run a transaction (Interchange) plus your provider’s markup. This payment processing rate plan itemizes costs by listing Interchange rates and markups separately.

.jpeg?width=600&name=Interchange-plus-rate-1%20(2).jpeg)

Your merchant statements may seem more complicated with IC-plus because there will be many transaction types listed, each with its own unique IC rate. But the major advantage here is gained transparency into what you’re being charged. You’ll have a true understanding of what you’re paying your provider versus what gets paid to the card brands.

The Best Credit Card Processing Rates Ensure Savings

As we mentioned earlier, the rate plan that best fits your business depends on whether your business is new and how much you process in credit card transactions. Flat rate plans are simple, and have a quick set up, but are expensive. Tiered rate plans can be more cost effective than Flat, but they take longer to set up and give your provider room to hide fees. For mature businesses looking for transparency and next-day funding, IC-plus is the way to go.

We understand every business is different, but all strive to save where they can. Get a professional analysis of your current merchant statements and find out if it’s time for a new payment processing rate plan. Be proactive and take the time to determine which rate plan is best for you.

What payment processing rate plan are you on? Will you look into your current rate plan and see if there’s room for savings? Tell us more in the comments section below!