Read enough about PayJunction’s company culture, and it’s clear we prioritize long-term relationships over short-term profit. That’s not just a nice-sounding statement, it’s what we practice every day with our customers.

Since we launched our blog, we’ve largely focused on unethical billing issues. These are the unfortunate, but all-too-common, ways players in the payments space unfairly profit off their customers. Because everyone does it, there’s an assumption among providers that it’s OK. Business owners are left to believe they can’t escape fake fees and hidden markups because they’re the norm. Complex merchant statements make it challenging to spot these issues in the first place.

At PayJunction, we believe in integrity over profits. We’re disrupting our industry with transparency and environmental consciousness. We process payments ethically.

What does that mean? Because we look at thousands of merchant statements annually, we know the deceptive ways other providers often charge their customers. We aren’t keeping this knowledge to ourselves; we believe in empowering business owners with this information even if they aren’t our customers.

Over the past months, we’ve highlighted unethical billing practices that are riddled in other providers’ merchant statements. At PayJunction, we never charge our customers these fees under any guise.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Fake Credit Card Processing Fees

There are several fees that sometimes appear on merchant statements that are flat-out fake. These credit card processing fees only profit your provider, and don’t represent a pass-through fee.

This list of fees you should never pay your credit card processing company is by no means exhaustive (new fees seem to always creep up). If you spot these fees on your merchant statements, it’s time for you to find an ethical provider. We’ve included statement snippets showing what these fees might look like on your statements.

PCI Compliance Fee

If you’re not PCI compliant, your provider could be charging you a monthly, quarterly or annual fee as a penalty. This fee serves no purpose and does nothing to help you become compliant.

Partnering with an ethical credit card processing company to reduce your PCI scope and avoid this fee means better security for your business and customers and more money in your bank account.

Self-Assessment Questionnaire Fee

Piggybacking off the PCI compliance fee, this fee is imposed on businesses that don’t complete a self-assessment questionnaire (SAQ) to verify their PCI compliance. It essentially hits businesses twice for the same issue, and can be charged quarterly or monthly until an SAQ is submitted.

Due to the complexity of merchant statements, it can be difficult for businesses to even be aware of this expectation, making it easy for providers to get away with this ongoing fee.

The SAQ is a self-assessment, so there’s no valid reason for your provider to bill you.

Next-Day Funding Fee

Understandably, most businesses want their funds as soon as possible, which is why providers offer next-day funding. It doesn’t cost your provider anything to do this, but some charge a fee under the guise of providing a premium service.

You should never be charged to simply access your money when it's available for deposit.

EMV Non-Compliance Fee

There are many reasons why businesses have been slow to upgrade to EMV-ready credit card terminals. Instead of helping businesses achieve EMV compliance to effectively stop fraud and reduce the risk of bank-initiated chargebacks, some providers further penalize vulnerable businesses that haven’t upgraded in the form of an EMV non-compliance fee.

Tax-Reporting Fee

It’s a legal requirement for your credit card processing company to report your revenue to the IRS; however, some unethical providers see this as an opportunity to hit you with a fee. They get away with this so easily because it seems like a legitimate pass-through fee.

Your provider shouldn’t be making extra money to fulfill legal obligations, especially since there’s no fee associated with this and it’s out of your business’s control.

Inactivity Fee

A minimum-processing fee is legitimate, and covers the cost of keeping a merchant account open. That’s not what this is. An inactivity fee is charged by some providers when their customers don’t take any credit or debit card transactions within a given period of time. This penalty has nothing to do with how much you process over the course of a single merchant statement.

There is no cost to offset, so your provider should never charge you this fee.

Harmful Rate Plans and Terms

You could be overlooking a major component of your credit card processing: your rate plan. Every business is different, so there are pros and cons to each plan depending on your processing volume and maturity. We have a helpful breakdown here of the most common rate plans: Interchange-plus, Flat and Tiered pricing. At PayJunction, we only equip businesses with Tiered and Interchange-plus rate plans because they’re the most cost-effective and transparent for our customers.

Unfortunately, there are a few ways providers can take advantage of their customers even on an Interchange-plus plan. Furthermore, there are numerous ways providers can impose unfair contract terms and equipment leases on your business that make it painful for you to leave them (even when you should).

Here are a few tips to ensure you’re on a true Interchange-plus pricing plan (if that’s your current rate plan), along with some unsavory options you should avoid altogether.

4 Signs You’re Not on True Interchange

Although Interchange-plus is the best rate plan in terms of transparency and affordability, there are a few signals that can suggest your credit card processing company isn’t honoring the terms of its rate plan.

- Non-Qualified Interchange

We’ll start off with another completely fake fee: non-qualified Interchange. This confusing fee borrows terminology from another rate plan, which leads business owners to believe it’s legitimate.

With Interchange-plus pricing, your provider charges you the Interchange — or wholesale cost — for the transaction plus a flat markup. There’s no such thing as a non-qualified transaction on Interchange-plus. That’s how Tiered pricing works. Businesses on an Interchange-plus rate plan should look for this fee as an easy way to gauge their providers’ honesty.

- Interchange Not Refunded

Businesses on Interchange-plus pricing are entitled to Interchange reimbursements when they issue a refund. The provider’s markup is usually not returned.

Often, unethical providers pocket the Interchange on refunds simply because they think their customers will not notice. Since the transaction was reversed, it makes sense that your business shouldn’t have to foot the bill for the credit card processing.

Unfortunately, there are several additional ways refunds can cost your business more than they should.

- Padded Interchange

Interchange varies by card type: It increases as risk and reward goes up. That said, because all cards vary, it’s nearly impossible for a business owner to spot markups in Interchange rates. Spotting a markup requires a trained eye and thorough knowledge of each card’s standard rate.

In this example, the true Interchange is 1.65% +$0.10 as noted in Visa’s Interchange guide. However, the provider hid a 0.85% markup in the discount rate to make extra money off the transaction.

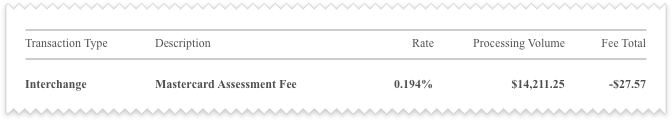

- Padded Dues and Assessments

Dues and assessments are legitimate fees that can be inflated by dishonest providers (more on credit card processing markups below). These rates should never exceed between 0.11% - 0.13% on Visa, MasterCard and Discover transactions. For Amex, dues and assessments should never exceed 0.15%.

We’ve seen numerous examples over the course of our business where competitors inflated these fees to make extra money off their customers. Most business owners don’t know the correct rate, which makes it easy to exploit.

Billback

Billback is the most-deceptive, and least-transparent, rate plan. We recommend avoiding it if possible. With Billback, providers propose a Flat rate for all transactions, which seems simple enough. However, the following month, the provider reviews the transactions and charges you for any that cost more than the proposed rate. You aren’t given any indication of which transactions didn’t qualify for the Flat rate.

With enhanced Billback, there’s even an added markup hidden in the next month’s statement that’s tacked onto the difference in costs between what you originally paid and what you owe.

Sound complicated? It is, which is why it’s best to simply avoid this rate plan entirely.

Unfair Contract Terms

Obviously, none of the unethical billing practices we’ve described so far are “fair,” but there are some harmful terms and conditions often buried in the fine print when you sign on with a credit card processing company. Here are a few to watch out for.

- Early Termination Fee

Exactly as it sounds, an early termination fee is charged when a merchant account is closed prior to the contract’s completion date. This fee works as an effective way of incentivizing business owners to not switch providers, which becomes an issue when combined with the next unfair contract term.

- Auto-Renew Clause

Again, just as it sounds, this clause stipulates that the merchant account contract will auto-renew if the account isn’t terminated within a small window of time. This term is often glossed over, ensuring that business owners don’t know when they’re eligible to terminate their contracts and, therefore, are more likely to miss the window.

Again, just as it sounds, this clause stipulates that the merchant account contract will auto-renew if the account isn’t terminated within a small window of time. This term is often glossed over, ensuring that business owners don’t know when they’re eligible to terminate their contracts and, therefore, are more likely to miss the window.

Terminal Leases

Many providers offer two options for their terminals: outright purchase or a monthly lease. Credit card terminals can cost anywhere from $150 to $500 each, so businesses that need multiple terminals often gravitate to the lease, which usually ranges from $20 to $40 a month.

The lease sounds more cost-effective at first, but it’s often paired with a two- to six-year contract. Over that time frame, a $500 terminal could end up costing $2,880 with a lease. Even worse, you could be paying for a terminal you don’t need if you end up switching providers.

Credit Card Processing Markups

Several of the fees listed above fall into the category of “markups,” such as padded Interchange and padded dues and assessments. Unsurprisingly, there are still more ways that your provider can mark up items in your merchant statements. We’ll equip you with some more facts to help you weed out unethical billing in your own merchant statements.

Inflated AVS Fee

Address Verification System (AVS) and Card Verification Value (CVV) are fraud-fighting measures. AVS checks that the customer trying to make a payment knows the billing address associated with the card. CVV confirms that the customer has physical possession of the card, since this numerical code is on the back of Visa and MasterCards, and the front of Amex cards.

These fraud-prevention measures are highly recommended for card-not-present transactions — running AVS actually lowers your rates for these transactions — but there is a small cost associated with AVS. It should be just $0.01 per use; however, some providers increase this fee with the assumption that their customers don’t know the actual cost.

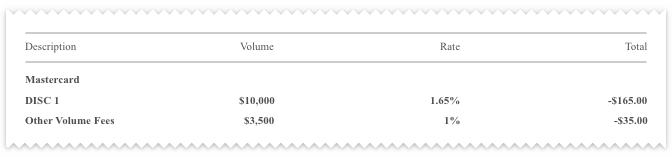

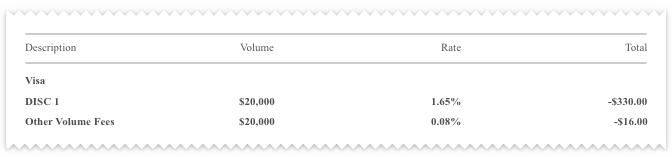

Hidden Volume Fee

Providers set credit card processing limits to protect themselves and their customers in the event of a large, fraudulent transaction. When PayJunction customers are approaching their limits for the month, we simply let them know. Other providers impose a volume fee on any portion exceeding the limit or even on the entire volume. In the examples below, the volume columns show this difference.

- Markup on a Portion of the Volume

- Markup on the Entire Volume

Although we covered a lot in this piece, it’s by no means a complete list of ways your provider could be taking advantage of your business. Partnering with a provider rooted in ethics and transparency is the best way to ensure your business is being charged fairly and is retaining the most money possible in its bank account.

Because these unethical billing practices are tough to spot with an untrained eye, our team is happy to review your current merchant statements to see if any of these issues are present. Simply request a statement analysis below.

Have you seen any of these unethical billing practices on your merchant statements? What pitfalls have you come across when selecting a credit card processing company? Let us know in the comments section below.

Editor's Note: This post was originally published in May 2017 and has been updated for comprehensiveness and accuracy.